VeriPlan is designed to help you pursue scientifically based financial strategies

Summary: VeriPlan's set of integrated financial calculators and investment calculators offer you unprecedented direct control to perform your own automated personal financial planning. VeriPlan's functionality also implements the principles of scientific finance. VeriPlan's internal documentation and its links to scientific finance information on the web help you to understand scientifically based personal financial planning and investment strategies.

The VeriPlan financial software reflects a belief that individuals will follow optimal, scientifically proven financial planning, investment management, and retirement planning strategies, if they understand scientific principles and have appropriate and powerful financial software calculators and planning tools. VeriPlan's simple premise is that people want to get the most out of their money in a manner that addresses their living expense budgeting needs across their lifecycle. While this objective is a "no-brainer," achievement of this objective requires steady and conscientious implementation over a lifetime. VeriPlan helps you to understand and to adopt financial planning practices that are more likely to achieve your lifetime objectives.

Providing extensive documentation embedded directly into the product where you need to find it, VeriPlan explains why its various financial calculator and investment calculator features have been implemented and how to use them. In addition, by providing links to scientific finance articles on The Skilled Investor website and elsewhere on the web, VeriPlan helps you to understand scientifically based personal financial modeling.

Whether you are wealthy or you intend to become so, VeriPlan investment growth calculator software is capable of generating lifecycle projections about your financial affairs. Explicitly or implicitly, every financial calculator or investment software tool for personal projections is designed with certain points-of-view. If you use a financial planning tool like VeriPlan, you should understand its viewpoints. On a separate, internal "Viewpoints" worksheet, VeriPlan explains many of the viewpoints that have influenced its design. As a sampling, some of these viewpoints include:

* Your personal earnings, expenditure budget, and savings are the most important and most reliable determinants of your family’s long-term financial net worth. Pay the most attention to these personal budgeting and savings topics.

* There is no such thing as risk-free money from investing for individual investors. You need to adopt an asset allocation strategy that reflects your relative tolerance for investment portfolio risk. You need to stay in the securities markets to earn investment returns. You need to build investment portfolio asset buffers to protect yourself from unpredictable market volatility and unplanned personal finance setbacks.

* Passive, index-oriented investment fund strategies tend to be superior, because they narrow the range of outcomes, and thus, they reduce the total investment risk associated with your investment portfolio. You should always have a completely diversified investment portfolio. Own investment funds rather than individual stock and bond securities. VeriPlan can easily model and project the value of your individual securities holdings, but low cost, fully diversified funds are more likely to achieve your lifetime objectives.

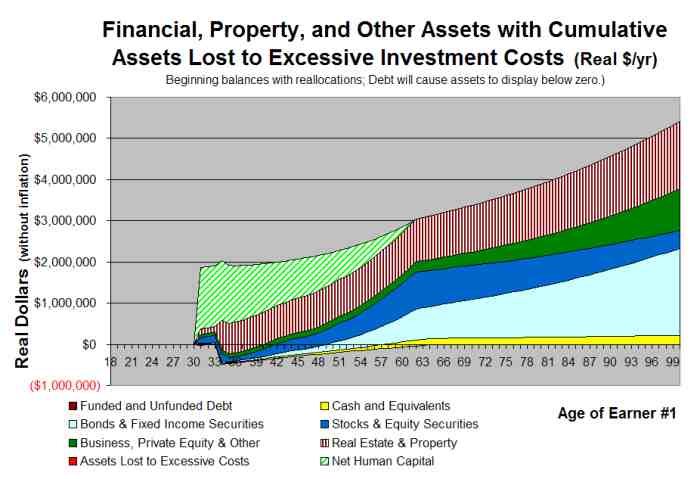

* Excessive visible and hidden investment costs tend to reduce the potential growth and value of your investment portfolio unnecessarily and dramatically. Cut your investment costs aggressively and keep cutting them. Pay yourself and not someone else.