Quicken and VeriPlan Comparison Estate Planning

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Estate Growth Projection Planner

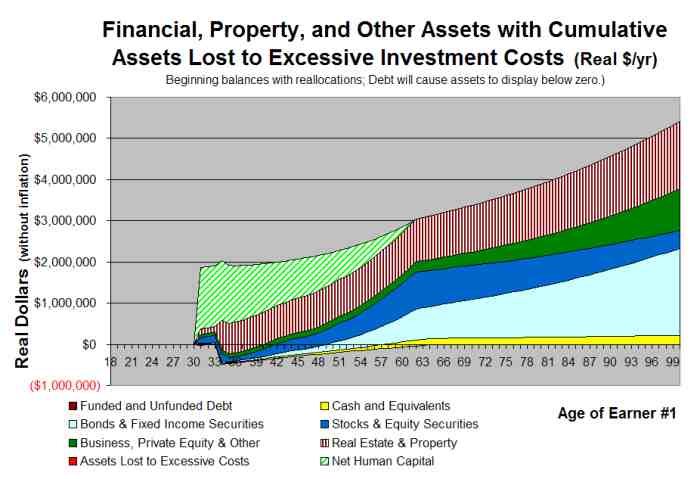

For every projection year through age 100, VeriPlan provides a breakdown of projected assets in the five main asset classes (see: Quicken and VeriPlan Comparison: Investments - Overview). VeriPlan provides year-by-year projections of financial assets in taxable, traditional tax-deferred, and Roth tax-advantaged accounts. In essence, VeriPlan's asset projection graphics and data sheets provide the projected value of the family estate (before estate taxes) in every projection year, as if one person might die in that year. (See: VeriPlan helps you to project the potential size of your estate in future years)

However, proper estate planning requires a competent estate lawyer. VeriPlan does not attempt to project the intricacies of estate values beyond the death of either person. VeriPlan always develops plans that assume full planned living expenses for both people through age 100 in the event that they were both to live that long. By analyzing VeriPlan's graphics and data tables, you will be able to tell if your plan might succeed for a couple through age 100 or at what age your plan might begin to fail before age 100.

Quicken Retirement Planner

The Quicken Retirement Planner requires the user to enter dates of death for both users. The Quicken Retirement Planner reports on the amount of assets or the estate remaining up until the projected death of the second person. Assets in taxable accounts and in the tax-deferred accounts are reported annually until that year. However, it is not clear what the Quicken Retirement Planner does, if you were to assume that one person dies before the end of the full projection period, which the Quicken Retirement Plan suggests that you do. Quicken instructs you to make manual adjustments for changes in living expenses after the first person dies.

However, the Quicken Retirement Planner does not explain how, for example, it reflects the potential revaluation to current market value of the tax basis of family assets upon the death of one spouse. Once the tax basis of family assets resets to current market, taxes due could change dramatically and would significantly affect the survivor's finances during the remaining years of the plan. The Quicken Retirement Planner does not seem to do estate planning, but it does project asset values beyond the death of one spouse.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.