VeriPlan's personal financial planning software helps you to understand how your current savings rate affects your future personal finance goals

Along with your efforts to increase your earned income, your personal savings rate largely determines your lifelong financial planning success or failure by steadily and more substantially feeding your investment portfolio. The attempt to be clever in the selection of particular investment securities is a far less reliable, less important, and most often negative factor in your long-run personal finance success.

You always should consume currently at rates that are more likely to assure a sustainable lifetime personal finance plan. Valuable investment portfolio assets and investment returns that many people will never have slip through their fingers at the checkout stand every day. Simply put, most people should budget and save more than they do. But, how much current saving and budgeting is enough?

The VeriPlan financial software can help you to understand sustainable projected budget expenditure levels that would still allow you to achieve your lifetime personal finance goals.

When you use VeriPlan's fully integrated financial calculators and investment calculators, it will become clear that relatively small percentage changes in your financial budgeting practices that are sustained over many years can have a very significant cumulative impact on on your lifetime personal finances.

Financial Planning Software Worksheets

Since the future offers neither any guarantees nor any predictability, you must also restrict your current consumption budget to build substantial investment portfolio assets that can provide safety buffers for times of future difficulty, to fund your retirement planning, and to provide for an estate, if desired.

You need a means to evaluate what is a sustainable lifecycle consumption rate. The VeriPlan financial software provides such a means by automatically developing highly personalized lifecycle financial modeling projections for you. While most people tend not to budget and save enough, VeriPlan is not a "you must always save more" financial modeling engine. VeriPlan projects your wealth and therefore your potential estate in each year through age 100. You can adjust any of your projection assumptions and decide for yourself about where to set the wealth management balance between your current expenditure budget and your projected estate (or lack thereof) in the future. Those who budget and save significant amounts and/or who already have substantial investment portfolio assets can use the VeriPlan personal finance software to help to decide when they are comfortable with increasing their current consumption.

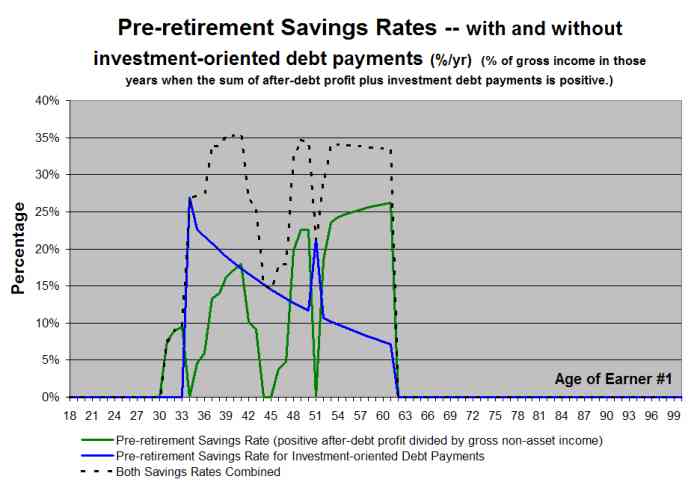

An example of VeriPlan's SAVINGS % graphic: Pre-retirement Savings Rates - with and without investment-oriented debt payments (%/yr)

Below is an example of the blue-tabbed 6-SAVINGS % graphic, which comes from VeriPlan's "Sue and Sam Saver" tutorial. This graphic shows Sue and Sam's projected savings rates from earned income prior to their retirement.

This graphic projects your savings rates with and without your investment-oriented debt payments. Particularly early in many people's lifecycles, it can seem difficult to save. Savings is always important, and it is useful to recognize that investment-oriented debt payments are a form of savings. When such debt has been retired, then your "normal" savings rates usually need to increase substantially to ensure that adequate assets will be accumulated prior to retirement.

This 6-SAVINGS % graphic projects your annual savings rates up to the planned retirement age of Earner #1. Unless Earner #2 retires later or your retirement income is projected to exceed expenses, VeriPlan's income-related graphics beyond retirement age would show asset withdrawals or negative savings rates.

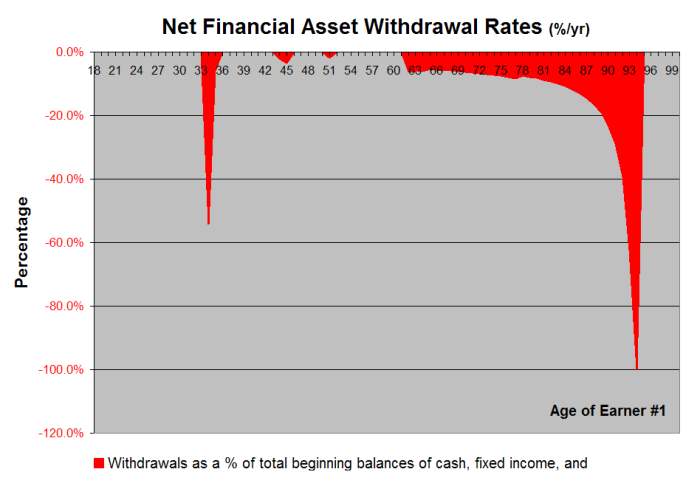

Projected withdrawals are shown on VeriPlan's withdrawal graphics.

Here is an example of VeriPlan's withdrawal graphic.

This withdrawal graphic shows Sue and Sam's projection which uses industry average investment costs. VeriPlan automatically extracted the investment cost information that Sue and Sam provided about their portfolio on VeriPlan's yellow-tabbed assets worksheets. Sue and Sam pay investment costs that are about average for full service retail brokerage customers.

This graphic raises a siginificant concern that their financial assets will be exhausted in their early 90s, when their withdrawal rates rapidly climb to 100%. Withdrawal rates in the 3% to 5% range are usually considered potentially sustainable.