Use the best bond investment calculator to understand the projected value of your bond and fixed income assets across your lifetime

To develop your lifetime and retirement calculator projections using VeriPlan’s compound investment calculator software, you can enter as many as 24 separate bond and fixed income asset holdings. For each of your current bond and fixed income holdings, you can also enter your investment fees and your tax basis. In addition, you can indicate whether you hold a particular bond or fixed income asset 1) in a taxable account, 2) in a traditional IRA, 401k or other traditional retirement plan investment account, or 3) in a Roth IRA, Roth 403b, Roth 457, or Roth 401k account.

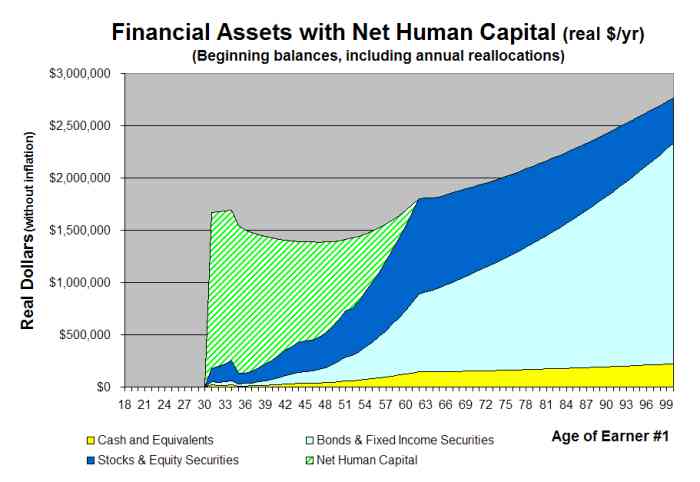

Using the information that you provide about your current cash, bond, and stock asset holdings, VeriPlan’s investment growth calculator functionality will automatically project your lifetime annual net worth — net of the investment costs and tax characteristics of your current financial investment portfolio. In addition, the VeriPlan savings and investment calculator automatically analyzes your cash flow and projects your year-by-year positive and/or negative net income from your earned income and other non-asset income sources, after your projected annual living expenses would be paid.

Then, VeriPlan automatically projects your return on investment and investment portfolio growth, according to the particular asset allocation method that you chose from among the five user customizable methods that are provided with VeriPlan’s asset allocation tool. Through its easy-to-use and fully integrated

- cash savings and investment calculator,

- bond investment calculator,

- stock investment calculator,

- mutual fund investment calculator,

- 401k investment calculator,

- IRA investment calculator, and

- Roth IRA investment calculator software features,

you can experiment with different cash, bond, and stock investment percentages across your lifetime.

A VeriPlan lifetime cash, stock, and bond investment calculator projection graphic with an increasing allocation to bond or fixed income investing:

The VeriPlan retirement planning software also acts as an annual income tax estimator and asset tax estimator for every year of your lifetime. VeriPlan automatically takes into account and reports on your investment costs and your projected capital gains tax obligations. Your VeriPlan hypothetical investment calculator projections always maintain a separation between your taxable accounts, your traditional IRA, 401k and other traditional retirement investment accounts, and your Roth IRA and Roth 401k accounts.

Taxes on your projected asset returns and withdrawals are applied differentially, depending upon the current rules for each type of account. When you enter your current investment costs, the VeriPlan retirement investment calculator automatically measures the cost efficiency of your financial asset portfolio related to the five major types of investment costs. VeriPlan’s cost efficiency projections are automatically weight-adjusted by the value of the assets that you hold in each of your cash, bond, and stock asset accounts across you lifetime.

Internally, the VeriPlan future value investment calculator maintains separate information for each of your individual portfolio accounts throughout your lifetime projections. This very detailed approach allows VeriPlan to project automatically your overall portfolio tax efficiency and investment efficiency for each year of your lifetime projection.

VeriPlan does this even though the net values of your individual asset holdings may change at different rates due to differences in investment returns growth, costs, and taxes. By avoiding the use of arbitrary averages across groups of investors, VeriPlan gives you much more personalized and deeper insights into your projected financial planning circumstances.