VeriPlan projects your U.S. federal, state, and local lifetime taxes (VeriPlan Overview: Part 5 of 7)

Find the latest VeriPlan information here -- >> https://www.theskilledinvestor.com/VeriPlan/

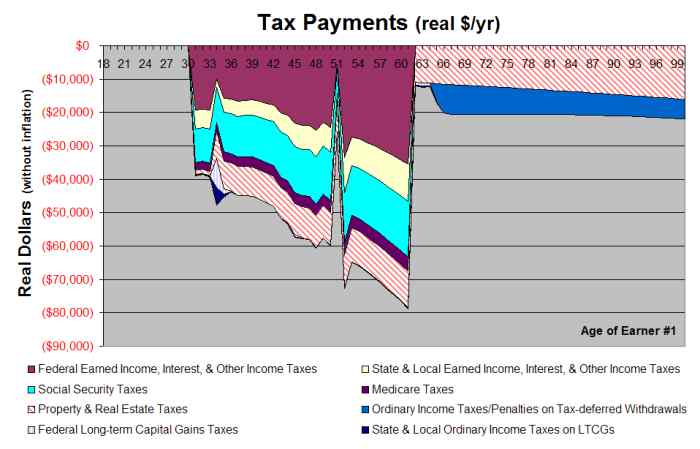

With its fully integrated lifetime tax calculator and income tax estimator features, the VeriPlan personal finance software automatically projects your lifecycle tax obligations in eight different tax categories. VeriPlan automatically projects your financial plan using the particular federal taxes, state taxes, and local income tax rates and limitations that currently apply to you. It also projects your income tax exemptions, tax adjustments, and tax deductions plus your property taxes and other taxes. To prevent obsolescence, the VeriPlan personal financial management software allows you to change the tax rates and limits that its tax calculator uses, in case tax laws change in the future.

Federal Income Tax Rates and Limits:

VeriPlan' financial software automatically applies current variable U.S. federal ordinary income tax rates and limits.

State Income Tax Rates and Limits:

VeriPlan automatically applies your state's current variable or flat ordinary income tax rates and limits. VeriPlan provides income tax rates for the 50 U.S. states and Washington, D.C., and you can select any one of them.

Local Income Tax Rates and Limits:

The VeriPlan tax calculator automatically applies any local ordinary income tax rates and limits that you supply. It can project a) no taxes, b) flat tax rates, c) variable tax rates, or d) New York City income tax rates, which are provided.

Taxable Income Differences:

States and localities may adjust your federal taxable income. VeriPlan can automatically develop projections that use different levels of taxable income at the federal, state, and local levels.

Income Tax Filing Status:

VeriPlan supports the 'Single' federal income filing status and the "Married, Filing Jointly' filing status, and it automatically applies the tax rates and limits that are associated with these filing statuses.

Income Tax Exemptions:

VeriPlan's financial planning calculators automatically project annual tax exemptions and their phase-outs for up to 10 dependents. (Note that this functionality has been suspended given the 2017 tax law changes, but the functionality has been maintained in case the laws revert in 2025.)

Income Tax Adjustments:

VeriPlan automatically projects annual tax exemptions for up to six different adjustments to your taxable federal income. It also manages differential growth rates and phase-outs.

Income Tax Deductions:

VeriPlan automatically projects your multi-year federal income tax deductions. In each projection year, VeriPlan automatically applies the more favorable of either the standard deduction or your itemized deductions.

Social Security and Medicare Taxes:

VeriPlan automatically applies Social Security (FICA) and Medicare taxes. It automatically projects either employee or self-employment tax rates, as appropriate.

Investment Taxes:

VeriPlan automatically applies long-term qualified dividend and capital gains taxes on your capital distributions and asset withdrawals net of your accumulated asset tax basis. For each of your asset holdings, you can provide your current asset tax basis. Across your lifecycle projections, VeriPlan will automatically increase and/or reduce your aggregate tax basis for your cash, bond, and stock asset classes.

Property and Real Estate Taxes:

VeriPlan automatically projects your total property, real estate, and other assessment taxes. You can also project that your property taxes will grow at a rate different from inflation.

Your Tax-advantaged Retirement Plans:

To the extent possible, VeriPlan has automated your lifecycle projections regarding the various employer retirement plans and personal retirement accounts that allow you to defer taxation or to avoid future taxation altogether. VeriPlan automatically projects separate values for your taxable accounts, traditional 'tax-deferred' accounts, and Roth retirement accounts. VeriPlan has fully automated the projection of your IRA contributions, deductions, asset growth, withdrawals, and taxation for both traditional tax-deferred IRA accounts and Roth IRA accounts. When necessary, the VeriPlan tax calculators automatically assess federal early withdrawal penalties, which are supplied by VeriPlan, and any state penalty that you enter.