Quicken and VeriPlan Comparison User Interface and Data Entry

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Financial Lifecycle Planner

VeriPlan provides 34 user worksheets organized into groups with the same colored tabs. Worksheets stay in a fixed location and each opens one at a time to cover the full screen, when its tab is selected. VeriPlan’s primary worksheet groupings and the number of worksheets in each group are:

- Information worksheets (4 red tabs)

- Input worksheets

> User Profile and Tools worksheets, including an overview (11 yellow tabs)

- Central reference and links worksheet (1 purple tab)

- Output worksheets:

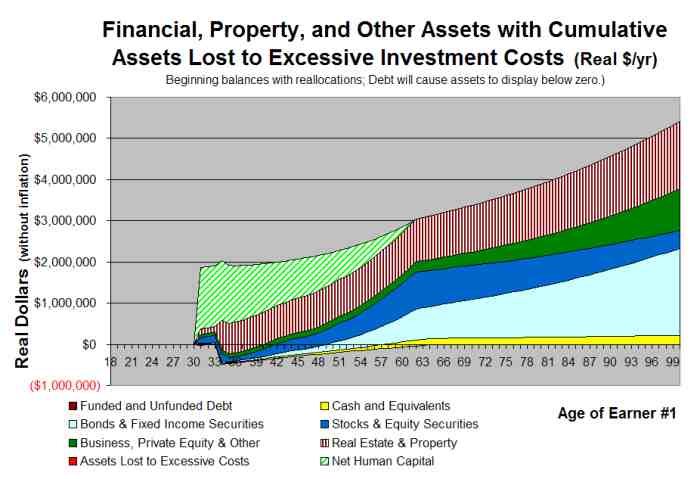

> Graphics worksheets, including an overview (21 blue tabs)

> Data worksheet -- a consolidated table of all output data (1 green tab)

> Projection Model Comparison Tool worksheets (4 orange tabs)

You can easily customize any of your data and settings in VeriPlan. VeriPlan provides input worksheets where you can choose various projection settings and enter your income, expense, debt, asset, and tax information.

Quicken Retirement Planner

From its "Planning" pull-down menu, Quicken offers a variety of planning functionality in smaller pop-up windows that the user can be move around. The Quicken Retirement Planner is Quicken's long-term personal financial planning application, and it offers a variety of planning components, including: "Income," "Taxes & Inflation," "Savings & Investments," "Homes & Assets," "Loans & Debt," "Expenses," and "Results." The Quicken Retirement Planner has a left-hand column that lists these integrated planning components, which will open when clicked.

Other Financial Calculators on the Quicken Planning menu are not the same as the similarly named functionality within the Quicken Retirement Planner. These additional Quicken Financial Calulators are simple calculators. Each displays in a single and separate pop-up window, and they are not integrated with the Quicken Retirement Planner.

The Quicken Retirement Planner can use some of the data that a user may already have entered into the Quicken expense tracking application. For example, using a one by one process in the Investments section of the Quicken Retirement Planner, you are given the option to select which of your current investments to include in your retirement plan using one of the data entry pop-up boxes. You can enter additional planning assumptions into a variety of pop-up boxes and forms within those boxes.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.