Quicken and VeriPlan Comparison Product Obsolescence

In this series of short personal finance articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Financial Lifecycle Planner

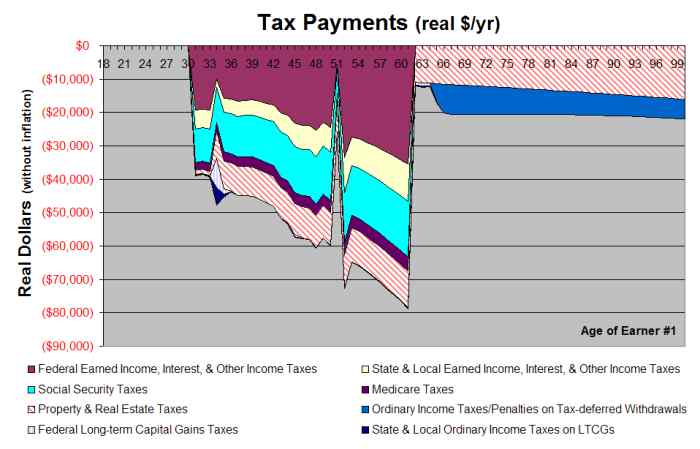

VeriPlan includes the latest available federal and state tax rules and limitations. To prevent obsolescence, you can change VeriPlan's income tax rates and limits, asset return assumptions, and a wide variety of other settings and data. Because of this ability to update tax rates, tax limits, and other assumptions, you do not have to buy upgrades to keep current the original functionality that came with VeriPlan. VeriPlan is a fully integrated finance and investment calculator that will not run out of gas on you, once you have come to rely on its rich personal financial, investment, tax, mortgage, loan, retirement, and other software analysis capabilities.

Quicken Retirement Planner

Because the Quicken Retirement Planner does not provide built-in tax rates and assumptions about asset returns, you do not need to worry about the obsolescence of something that is not there in the beginning. In the Quicken Retirement Planner, you set an average tax rate and manually enter your own general investment asset return assumptions.

Concerning contributions to traditional and Roth tax-advantaged plans, Quicken does not show you the settings that it actually uses, and it does not provide places for you to make any changes. In contrast, VeriPlan exposes all these settings and permits the user to change them.

Quicken's user documentation does offer a place for you to check some of Quicken's assumptions. On the page "What do I need to know about assumptions in the Life Event Planner calculations?" Quicken allows you to "check that these assumptions about financial laws are still true." However, if things have changed you still are not provided any place to make changes.

Furthermore, in the version Quicken evaluated, the documentation referred to tax law settings from eight years prior. If you have a version of Quicken, you might check whether they are using more current tax law settings and whether they have updated the user documentation."

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.