VeriPlan automatically accumulates a consumption loan for you, if future expenses deplete your financial assets

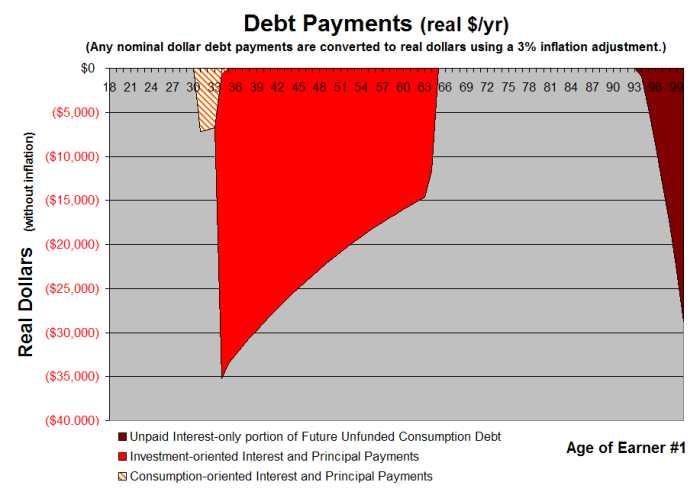

VeriPlan's "Debt Payments" graphic provides a full lifetime picture of your annual debt payment obligations. The Debt Payments graphic, which VeriPlan develops automatically for every projection, projects your annual debt repayment obligations according to your settings on VeriPlan's 'Your Debts' worksheet.

On the 'Your Debts' worksheet, you also classify your debts as consumption-oriented or investment-oriented. Consumption-oriented debts represent past consumption that you have financed. Investment-oriented debts are those you take on with a rational expectation that they will enhance your human capital and/or portfolio assets.

If at any point in the future, your expenses would exceed your net income and would fully deplete your accumulated cash, bond, and equity financial assets, then VeriPlan automatically begins to accumulate an "unfunded consumption debt" loan for you.

Lifetime Financial Planning Worksheets

The first VeriPlan tutorial graphic below shows a projection from the VeriPlan "Sue and Sam Saver" tutorial, which is included on the VeriPlan CD. This graphic shows Sue and Sam's lifetime debts, when they project that they will pay industry average investment costs across their lifetimes.

VeriPlan

automatically extracted the investment cost information that

Sue and Sam provided for their current investment asset portfolio on

VeriPlan's

assets worksheets. Sue and

Sam pay investment costs that

are about average for full service retail brokerage customers. The

year-after-year cumulative and compounded lost investment earnings and

asset growth due to these cost inefficiencies would dramatically

undermine Sue and Sam's personal assets.

When Sue and Sam pay these higher industry average investment costs, VeriPlan projects that they would pay off their debts by their mid-60s. However, since their investment costs are substantial, their lifetime investment returns are projected to be much lower. Along with their other living expenses, their investment costs cause Sue and Sam's cash, bond, and stock assets would be gone in their mid-90s. Thereafter, VeriPlan automatically accrues an unfunded consumption debt of both principal and interest through age 100. Even though their financial assets are gone, their living expenses would continue.

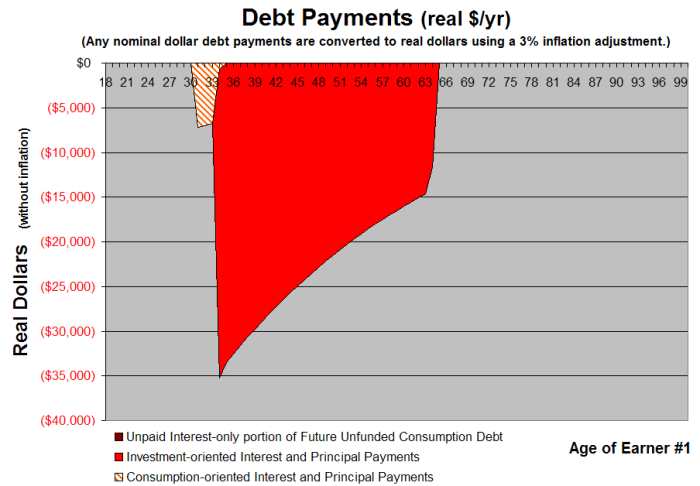

The lifetime debt payments graphic below shows a revised projection that uses lower, more reasonable investment costs.

When Sue and Sam decide to pay lower, more reasonable costs during their lifetimes, with a single change in VeriPlan they can switch on their reasonable cost assumptions in Section 4 of VeriPlan's "Cost-Effectiveness Tool" worksheet. All other projection assumptions and data in VeriPlan remain the same in these two scenarios. Only the level of investment costs changes.

When Sue and Sam use their reasonable cost assumptions, VeriPlan's debt payments graphic projects that their debts would be paid off in their mid-60s, just like the previous projection. However, in this case they do not run out of money in their 90s, and therefore they do not have to incur any unfunded consumption debt. Their cash, bond, and stock assets are sufficient, if they were both to live to age 100.

VeriPlan's debt management planning facilities automatically handle your current mortgages, lines of credit, bank loans, student loans, revolving credit arrangements, credit cards, or other types of loans.

For your current debts, the VeriPlan lifetime personal financial planner will deduct interest and principal payments from your projected annual after tax cash flow for as long as any unpaid principal on these debts would remain. VeriPlan's fully integrated mortgage and loan calculator functionality can automatically project interest and principal payments on up to 25 of your currently outstanding debts. You can project that you will pay off your debts as required, or you can accelerate the payoff of any or all your current debts.