College savings calculator software helps you to plan college savings and other education expenses for you and your children

VeriPlan’s fully integrated and automated financial calculators and financial software tools help you to determine whether your current savings rate would lead to a sustainable financial plan across your lifetime.

In addition, the VeriPlan lifetime retirement planning calculator also can be used as a college savings calculator to test how earning, budgeting, spending, and saving more or less would affect the viability of your educational expense planning program during any year of your lifetime. In addition to projecting your yearly ordinary living expense budget across your lifetime, VeriPlan lets you plan for major expenditures, including private preparatory school and college education costs.

When used as a children’s education expense planning tool, VeriPlan acts as an education savings calculator that can help you to understand your education savings needs by:

- projecting annual expenses for any number of children in private preparatory schools, college, and graduate school

- growing projected educational expenses with inflation or at rates that differ from expected inflation

- offsetting costs by anticipated educational scholarships, grants, and loans

A separate section of VeriPlan’s Expense and Savings Tool provides a detailed example of using VeriPlan as a college saving calculator that plans the future college savings, college expenses, college scholarships, and college loans for children who currently are young.

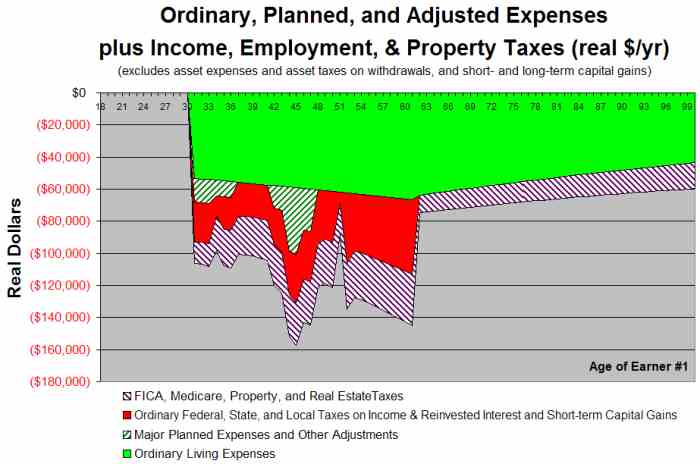

An example of VeriPlan’s expenses graphic that includes college planning expenses for children integrated with all other projected family expenses

Below is an example of the VeriPlan’s expenses graphic: “Ordinary, Planned, and Adjusted Expenses plus Income, Employment, & Property Taxes (real $/yr).” This graphic shows Sue and Sam’s projected living expenses, ordinary income taxes, and their FICA (Social Security), Medicare, Property, and Real Estate tax payments. This expenses graphic, which VeriPlan automatically develops for every financial plan, projects your expenses related to living expenses and the taxes that are related primarily to non-asset earned and retirement income. This graphic includes:

- Your ordinary living expenses and major planned expenses with adjustments and with your real dollar growth rates from the orange-tabbed ‘1-Expense & Savings Tool’ worksheet

- Your federal, state, and local ordinary income taxes from the yellow-tabbed ’11-Your Taxes’ worksheet

- Your federal, state, and local ordinary income taxes on asset income and reinvested interest and short-term capital gains from the yellow-tabbed ‘6-Your Cash,’ ‘7-Your Bonds,’ and ‘8-Your Stocks’ worksheets. (Because ordinary earned income and ordinary asset income tax treatments are similar, VeriPlan combines both earned income and asset income sources here for taxation purposes. Generally, most asset income taxes will be from current interest and dividend payments on cash and bond/fixed income assets.)

- Your tax payments related to FICA (Social Security), Medicare, self-employment, property, real estate, and other non-capital gains taxes

Concerning their use of VeriPlan as a college planning tool for their children’s college expenses, note the substantial additional amount of “major planned planned expenses,” when Sue and Sam are in their early 40s. These added expenses represent the net additional out-of-pocket cash expenses that are projected related to sending two children – who differ in age by two years – to college over a six-year period.

In this particular VeriPlan college expense calculator planning scenario, they would have to withdraw about a 50% of their cash, bond, and stock assets at that time to pay for their children’s college education! Note that these expenses are net of projected college expense inflation and anticipated college scholarships and college education loans.

Furthermore, note that the earlier group of “major planned planned expenses” displayed on this graphic represents projected expenses related to purchasing and furnishing a single family home during their early-30’s. These two separate financial planning goals related to real estate buying and children’s college education planning are fully and automatically integrated into a single, unified lifetime financial plan that includes all other expenses, including their pre-retirement and post-retirement ordinary living expenses.