Decide whether accelerated mortgage debt and other accelerated loan repayments make sense for you

The VeriPlan personal finance software allows you to evaluate different loan payoff strategies across your lifetime financial plan. You can model higher monthly payments that accelerate the repayment of any particular loan or all loans. VeriPlan will automatically shift some of your positive net earned income cash flow toward accelerated debt repayment and away from additional cash, bond, and stock investment portfolio assets.

VeriPlan’s fully integrated mortgage calculator, loan calculator, and debt payoff functionality functionality can automatically project interest and principal payments on up to 25 of your currently outstanding loans.

The VeriPlan lifetime personal financial planner will continue to deduct interest and principal payments from your projected annual after tax cash flow for as long as any unpaid principal on these debts would remain. VeriPlan’s debt payoff software handles mortgages, lines of credit, bank loans, student loans, revolving credit arrangements, credit cards, or other types of loans.

Test the overall impact of accelerated debt repayments within the context of your full lifetime income, expense budget, assets, and taxes.

For example, VeriPlan automatically takes into account the tax deductibility of your property tax payments and your mortgage and real estate line of credit interest payments, when it projects your federal income taxes, state income taxes, local income taxes, and property taxes.

People usually consider the question of accelerating debt repayments, when they expect to have steady positive net income or cash flow to cover their debt repayments. The VeriPlan personal financial planner does not require this. VeriPlan can automatically project the financial impacts of minimum required loan repayments and/or accelerated debt elimination payments on a loan by loan basis over multi-year periods with fluctuating positive and negative annual cash flows.

Furthermore, if your projected cash flow in any projection year would not be sufficient to meet either your required or accelerated debt payoff strategy, then VeriPlan would draw down your projected cash, bond, and equity assets. As required, VeriPlan would automatically project the liquidation of your projected financial assets in proportion to your chosen investment portfolio asset allocation.

VeriPlan is the most comprehensive, integrated, and automated financial planner and debt payoff software application that is available for personal use. It can easily help you to make better, more optimal financial decisions that take into account your full lifetime financial plan.

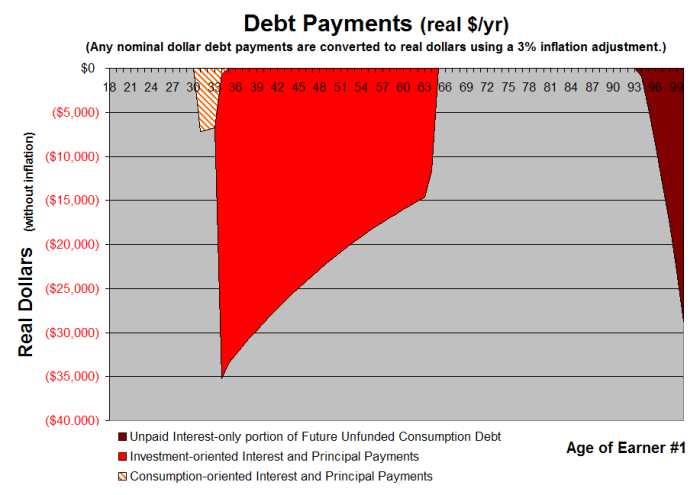

VeriPlan’s “Debt Payments” graphic provides a full lifetime picture of your annual debt payment obligations.

VeriPlan Debt Payments graphic, which is developed automatically for every projection, projects your annual debt repayment obligations according to your settings on VeriPlan’s ‘Your Debts’ worksheet. On VeriPlan’s ‘Your Debts’ worksheet, you also classify your debts as consumption-oriented or investment-oriented. Consumption-oriented debts represent past consumption that you have financed. Investment-oriented debts are those you take on with a rational expectation that they will enhance your human capital and/or portfolio assets.

The sample graphic below shows a projection for “Sue and Sam Saver”. In this scenario, VeriPlan projects that Sue and Sam would pay off their debts by their mid-60s. However, since their cash, bond, and stock assets would be gone in their mid-90s, VeriPlan would automatically accrue an unfunded consumption debt thereafter. Even though their financial assets are gone, but their living expenses would continue. (They might have other assets, such as real estate property, that could help them to avoid this future debt.)