VeriPlan's 10 Personal Financial Planning Tools and Financial Calculators

Overview

The VeriPlan personal finance software gives you significant personal insight into your most important financial planning and investment portfolio management decisions. Through comprehensive and customized lifetime projections, VeriPlan's financial calculators and investment calculators model your particular financial planning across your adult lifecycle. VeriPlan projects fully integrated scenarios about your income, expenses, debts, assets, investment returns, and investment costs within the context of the U.S. federal taxes, state taxes, and local taxes that apply to you. VeriPlan presents all your personal lifecycle projection information in clear graphics and data tables. You can easily customize any of your personal data and settings in VeriPlan. After you make any modification, VeriPlan will revise your complete projection automatically and instantaneously. Using VeriPlan's rich set of 10 fully integrated “what if” financial planning tools and financial calculators, you can take greater control of your own financial planning and personal investment decision-making. For additional information, see the VeriPlan Executive Summary or the VeriPlan Product Overview.

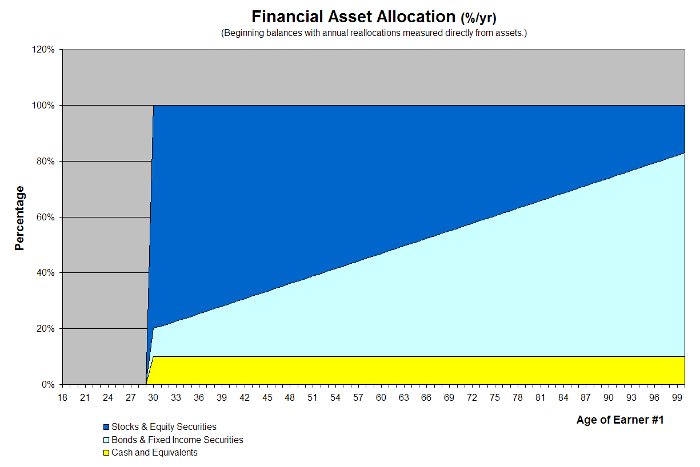

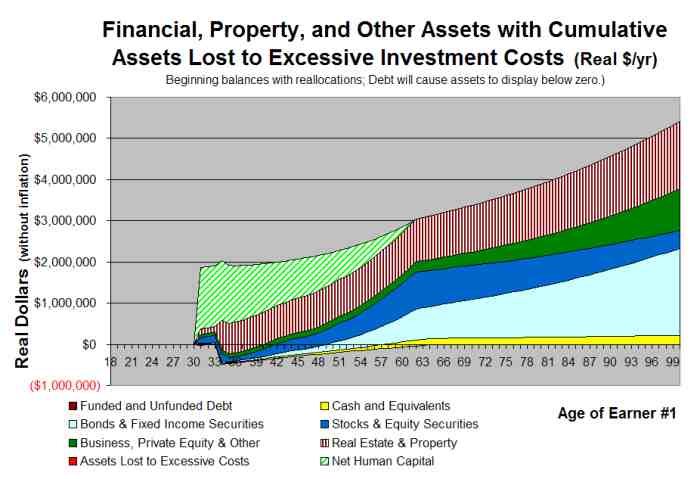

Asset Allocation and Rebalancing Tool

Your asset allocation strategy allows you to align the risk of your investment portfolio with your relative risk tolerance. VeriPlan provides five user selectable and adjustable asset allocation methods for your lifecycle projections. Fixed, variable, and age-based asset allocation mechanisms are provided. Reallocations are performed automatically at the beginning of all subsequent projection years.

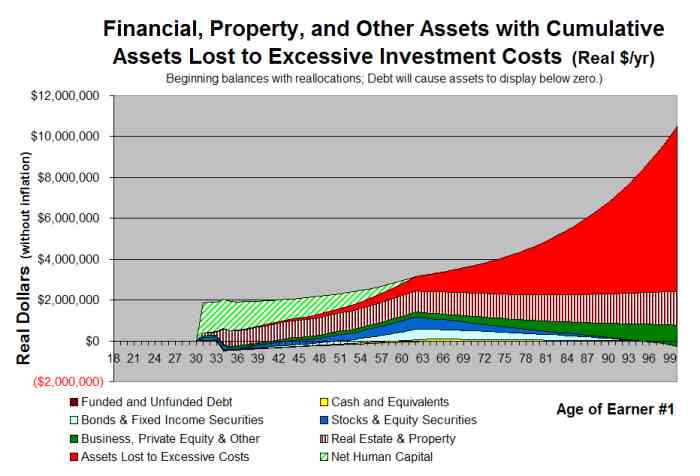

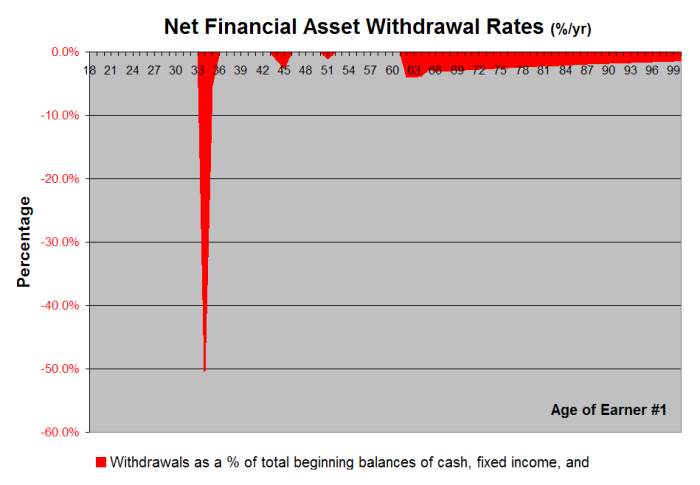

Investment Cost Effectiveness Tool

Excessive

investment costs are a huge problem for the average individual

investor.

VeriPlan's projections automatically analyze the impact of five types

of investment expenses across your lifecycle: 1) purchase fees and

loads, 2) management expenses, 3) marketing fees, 4) trading costs,

and 5) investment portfolio custody fees. VeriPlan fully automates the

comparison of

your lifecycle investment portfolio costs. VeriPlan's automated

investment calculators allow you to compare the lifetime investment

costs of your current investment portfolio with investment

costs that you believe are reasonable to pay.

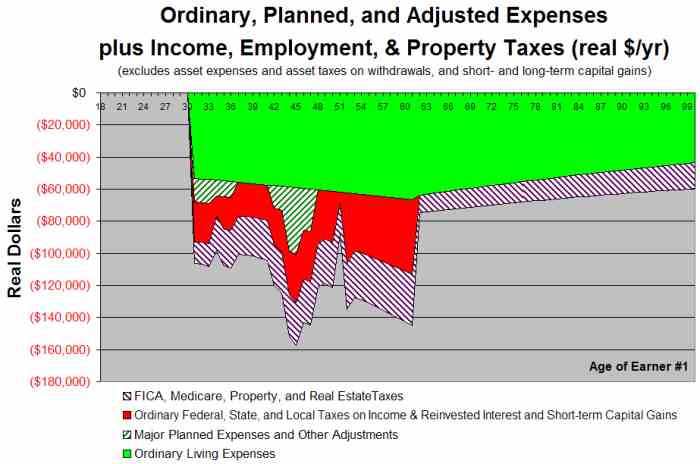

Expense Budgeting and Savings Calculator

VeriPlan's expense budgeting and savings calculator tool

allows you to change your current expense levels and future

expense growth rates. It also allows you to enter major planned

expenses and their growth rates for any future years. You can also

enter positive and negative expense budget adjustments and growth rates

for

any projection year. This savings calculator tool explains how VeriPlan

can be used as a

Children's Education Expenditure Planning Tool. It also has a section

on how to use VeriPlan as a Mid-Career Education Planning Tool to model

tradeoffs associated with returning to school for career advancement.

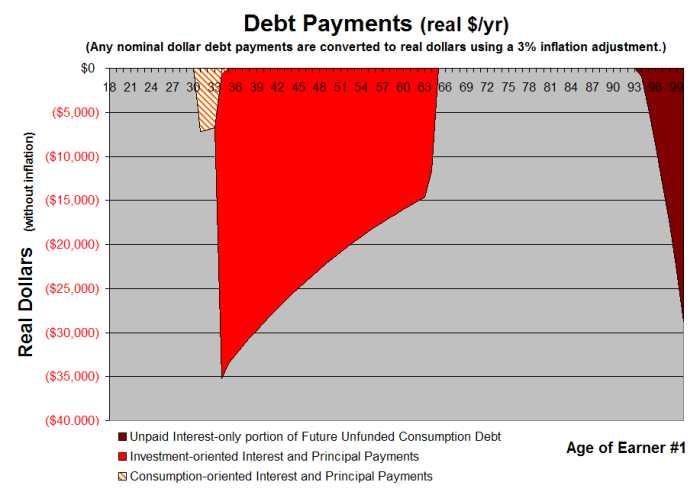

Future Debt Calculator

Excess consumption and the attendant costs of debt can be very

destructive. This tool allows you to set an interest rate for future

unfunded consumption debt. VeriPlan automatically accumulates an

unfunded

debt with unpaid interest, when your projected expenses exceed your

projected income and when your cash, bond / fixed income, and

stock / equity portfolio assets are projected to be depleted fully. If

subsequent positive net income becomes available, VeriPlan will

automatically pay off some or all of this unfunded consumption debt.

Regarding any current debts that you have, VeriPlan automatically

repays interest and principal required. You can use VeriPlan’s

debt management calculator facilities to analyze and plan the

accelerated

repayment of any or all of your loans.

Historical Asset Class Investment Returns

VeriPlan's automated "centerline" projections are based on the

very

long-term, historical securities market rates of investment returns

that have been

achieved in the cash, bond / fixed income, and stock / equity

investment asset classes

over approximately the past 75 years. You can adjust these projected

rates of return, using VeriPlan’s Portfolio Risk Tool.

VeriPlan’s projections automatically deduct your taxes and

investment costs from your investment returns. Furthermore,

across your lifecycle, VeriPlan will automatically project the value of

your real estate, property, and other assets, which are not priced

currently on real-time securities markets. VeriPlan will use fair

market value and future growth rate estimates that you provide for

these real estate, property, and other assets.

Home Purchase Calculator Tool

VeriPlan provides this calculator tool for users who plan to

purchase 1 to 3 homes

in the future. For future home purchases, this home purchase calculator

automatically takes

into account: a) the planned purchase price, b) closing

costs, c)

settlement cash required, d) mortgage debt to be assumed, e) expected

interim and subsequent price changes or appreciation.

Investment Portfolio Risk Tool

VeriPlan provides two combinable methods to develop

projections using

asset class return assumptions that differ positively and/or negatively

from VeriPlan's "centerline" historical investment returns assumptions:

- The Projection Variance Tool allows you to vary asset class investment returns upward or downward automatically in proportion to their historical volatility or investment risk.

- The Asset Class Return Adjuster allows you to vary rates of financial investment returns automatically on a one-by-one basis.

VeriPlan

also provides a Current Portfolio Revaluation Tool to help users

understand the potential effects of substantial changes in near-term

securities market values.

Investment Portfolio Safety Tool

Individual

investors face a dilemma. Both less risky and more risky investment

strategies may not achieve desired results for different reasons. When

assessing investment strategies with different risk levels, it can be

helpful to understand how the "safer" portion of your portfolio assets

might evolve across your lifecycle. VeriPlan's Portfolio Safety Tool

automatically projects how long your cash and shorter-term fixed income

assets would cover your projected expenses, if all your expected income

sources ceased at any point. This tool automatically measures your

projected financial capacity to weather future financial risks that

might materialize.

Retirement Calculator Tool

VeriPlan provides flexible financial

planning worksheets for

retirement planning. With this retirement calculator tool,

you can set individual retirement ages for Earners 1 and 2. You can

select whether or not to retire simultaneously. You can also adjust

your expected ordinary living expense budget in retirement and the

growth

rate of those living expenses. Concerning Social Security retirement

payments,

you can set current levels of your entitlements and adjust the age at

which you would first begin to receive Social Security payments.

Furthermore, you can scale back the amount of your projected Social

Security payments, if you wish. Finally, because much older workers can

face significant erosion of real dollar wage rates, you can adjust

VeriPlan's assumptions about real dollar wage erosion for earnings at

ages over 65.

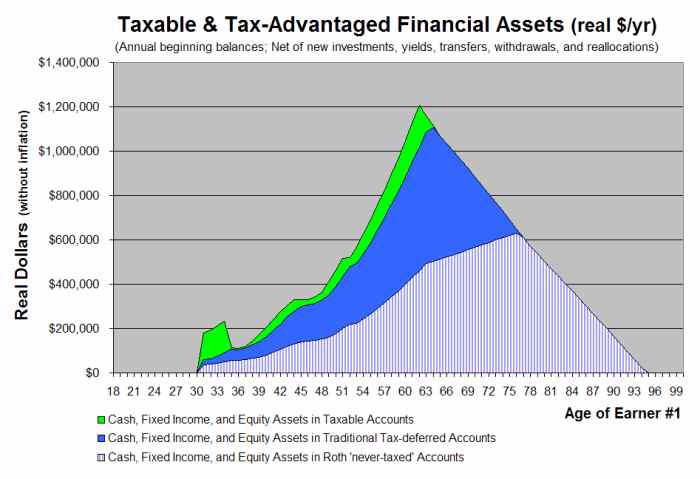

Tax-Advantaged Retirement Plan Tool

VeriPlan

has automated your lifecycle projections regarding the various employer

retirement plans and personal IRA, 401k, and other retirement accounts

that allow you to defer taxation or to

avoid future taxation altogether. VeriPlan automatically projects

separate values for your taxable accounts, traditional IRA and 401k

accounts, and Roth IRA and 401k accounts. Regarding traditional IRA

accounts and Roth IRA accounts, VeriPlan has fully

automated the projection of your lifecycle IRA contributions,

deductions, asset growth, withdrawals, and taxation. When necessary,

VeriPlan's financial calculators

automatically assess federal early withdrawal penalties that are

supplied and a state penalty that you provide.

Your settings on this retirement calculator tool will control your projected lifetime tax-advantaged retirement plan contributions that would be funded from your future positive net income and/or from your future taxable financial assets, up to the current legal annual limits. This tool allows you to determine the portion of your projected annual contributions that would be deposited automatically into either traditional accounts or Roth accounts.

- The Total Contribution Limitation Tool allows you to set your personal limitation on overall tax-advantaged account deposits, as a percent of your future annual positive net cash flows.

- The Roth Contribution Limitation Tool allows you to set the percentage that Roth 'never-taxed' contributions would be of your total annual contributions into both traditional 'tax-deferred' and Roth 'never-taxed' accounts.

Get the best financial

planning worksheets for retirement planning!