Executive Summary of the VeriPlan Personal Financial Software

VeriPlan Personal Financial Planning Overview:

The

VeriPlan personal financial planning software gives you significant

personal insight into your most

important financial planning and investment portfolio management

decisions. Through comprehensive and

customized lifetime projections, VeriPlan's financial calculators model

your personal

finance situation across your adult lifecycle. VeriPlan's fully

integrated financial calculators project scenarios about your income,

expense budget, debts, investment assets,

investment returns, and investment costs within the context of the U.S.

federal, state, and local taxes that apply to you. VeriPlan presents

all your personal lifecycle projection information in clear graphics

and data tables. You can easily customize any of your personal finance

data and

settings in VeriPlan. After you make any modification, VeriPlan will

revise your complete projection automatically and instantaneously.

Using VeriPlan's rich set of fully integrated “what if”

financial calculators, you can take greater control of your own

financial planning and personal investment management.

Organization, Projection Graphics, and Data:

VeriPlan provides 14 user worksheets and 20 graphics organized

into groups

with the

same color worksheet tabs. VeriPlan provides extensive internal and

external hyper-linking to help you to get around quickly. VeriPlan is a

lifecycle projection model for 1 or 2 "earner/users" from 18 to 100

years old. A projection can begin at any age from 18 to 99 and will

continue through age 100. Each of VeriPlan’s twenty

projection graphics covers ages 18 to 100 years in yearly increments.

VeriPlan automatically a consolidated data worksheet with a table of

all the annual data that VeriPlan uses to draw each of its 20

projection graphics. All VeriPlan projections extract inflation and use

real or non-inflationary dollars with constant purchasing power

projected across your lifetime.

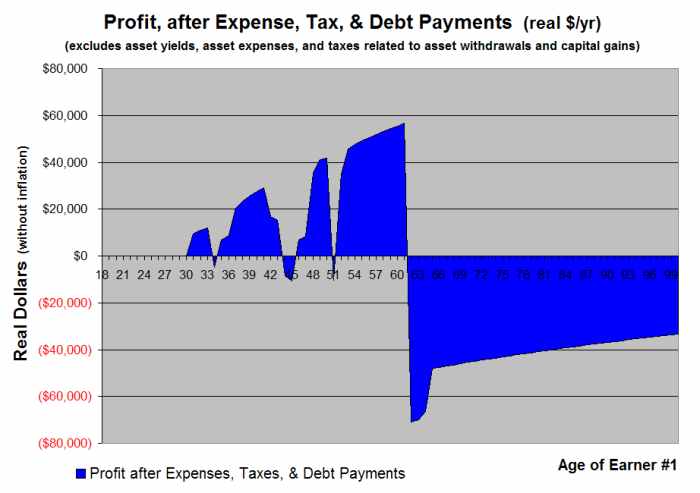

Earned Income and Other Income:

Regular employment and/or self employment income can be projected for each user. VeriPlan also allows you to enter information about other income sources that you expect to have, including positive and negative adjustments on a year-by-year basis. You can also fine tune expected real dollar growth rates on an annual basis for each income source.

Pensions, Annuities, and Social Security Income:

VeriPlan's retirement calculators project up to 10 separate

pensions and annuities. For each

pension or annuity, VeriPlan automatically projects: a) the dollar

amount of the monthly payment, b) separate real dollar growth rates

before and after the first payment, c) whether payments begin at a

specific age or at either user’s retirement, d) duration of

payments, and e) taxability of payments. Concerning Social Security

retirement planning, you can set current levels of your entitlements,

adjust the age to begin to receiving payments, and scale back the

amount of your projected payments, if you wish.

Debt Management:

VeriPlan's loan calculator automatically projects the pay-off

of up to 25 current debts.

You can plan for the accelerated repayment of any or all of your loans

and debts.

Interest on selected debts can be tax-deductible. In addition, the

VeriPlan home finance calculator

automatically manages your mortgage repayments on future home purchases.

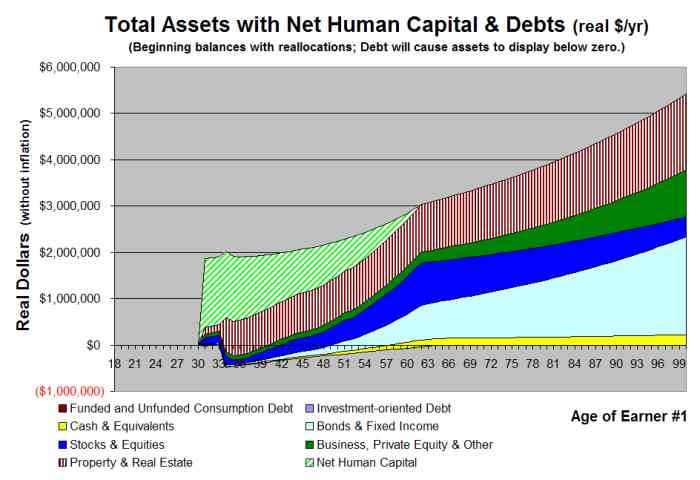

Investment Portfolio Assets and Investment Returns:

VeriPlan projects your investment portfolio asset holdings in five asset classes. Individually and automatically, the VeriPlan investment calculators will manage up to 24 cash assets, 24 bond and fixed income assets, 99 stock and equity assets, 10 property and real estate assets, and 10 other assets. For each of your investment asset holdings, VeriPlan collects information about share ownership, values per share, investment costs, account taxability, and expected taxable capital gains distributions.

VeriPlan’s integrated,

automated, and high performance investment calculators enable the

rapid evaluation of a wide range of customized personal financial

planning gaols. Growth

of your projected “centerline” investment portfolio values are

based on 85-year historical risk-adjusted and inflation-adjusted asset

class growth rates. Growth rates are fully user-adjustable using

VeriPlan’s systematic and judgmental growth rate adjustment tools.

For

each of your investment portfolio holdings, VeriPlan separately and

automatically projects annual investment returns, return volatility,

taxes, and

investment costs. VeriPlan automatically projects your net annual

holdings by asset class, including new financial portfolio investments

from future positive

net earnings, reallocations, and withdrawals due to future negative net

earnings. Then, in combination, the VeriPlan investment calculators

automatically assess your

overall annual net portfolio returns, tax-efficiency, and investment

cost-efficiency. VeriPlan can project these aggregates, even though the

net value of your individual asset holdings may change at

different rates due to investment returns adjustments that you make,

varying investment

costs, uneven capital gains tax distributions, legal

differences in taxes,

and variations in tax rates. VeriPlan provides significantly more

personalized insights, because its projections focus on your particular

projected lifetime financial planning situation and do not rely upon

averages for the general population.

Income Tax, Capital Gains Tax, Property Tax, and other Taxes:

VeriPlan's tax calculator functionality automatically projects

your lifetime tax obligations in eight different tax categories. It

automatically projects the particular federal income tax, state income

tax, and local income

tax rates and limitations that currently apply to you. It also projects

your personal tax exemptions, adjustments, and deductions plus your

property and

other taxes. To prevent obsolescence, you can change tax rates and

limits used by VeriPlan, in case tax laws change in the future.

1. VeriPlan automatically applies current variable U.S. federal income tax rates and limits on federal taxes.

2. VeriPlan automatically applies your current variable or flat state income tax rates and limits on state taxes. VeriPlan's tax calculator functionality provides state income tax rates for the 50 United States and Washington, D.C. You can select any of these state taxes to develop your financial planning projections.

3. VeriPlan automatically applies any local personal income tax rates and limits. It can project a) no taxes, b) flat tax rates, c) variable tax rates, or d) the New York City income tax rates, which are provided.

4. The VeriPlan tax calculators automatically develop projections that use different levels of taxable income at the federal, state, and local tax levels.

5. VeriPlan automatically supports the 'Single' and "Married, Filing Jointly' federal income filing statuses. The VeriPlan tax calculators automatically apply the tax rates and tax limits that are associated with these filing statuses.

6. The VeriPlan tax calculators automatically project annual tax exemptions and their phase-outs for up to 10 tax dependents.

7. VeriPlan automatically projects annual tax exemptions for up to six different adjustments to your income that is subject to federal taxes. It also manages differential income growth rates and income phase-outs.

8. The VeriPlan financial software automatically projects your multi-year federal income tax deductions. In each projection year, VeriPlan applies the more favorable of either the standard tax deduction or your itemized tax deductions.

9. VeriPlan automatically applies Social Security (FICA) and Medicare taxes. It automatically projects either employee or self employment tax rates, as appropriate.

10. The VeriPlan tax calculators automatically apply long-term qualified dividend and capital gains taxes on capital gains distributions and asset withdrawals net of your accumulated asset tax basis. For each of your investment portfolio holdings, you can provide your current asset tax basis. Over your lifecycle projections, VeriPlan will automatically increase and/or reduce your cumulative asset class tax basis separately for your cash, bond, and stock asset classes. VeriPlan also automatically calculates the NIIT.

11. VeriPlan automatically projects your total property taxes, real estate taxes, and other assessment taxes. You can also project that your property taxes will grow at rates different from inflation.

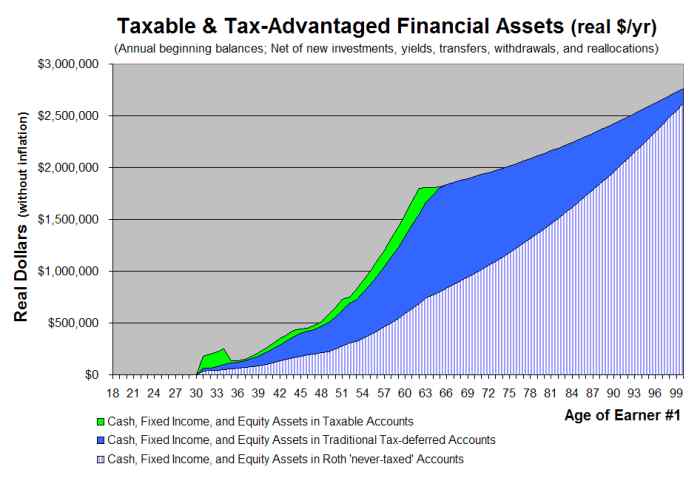

Tax-advantaged Retirement Plans:

To

the extent reasonably possible, the VeriPlan financial planning

software has automated your

lifetime projections regarding the various employer retirement plans

and personal

retirement accounts that allow you to defer taxation or to avoid future

taxation

altogether. VeriPlan automatically projects separate values for your

taxable accounts, traditional IRA and 401k retirement accounts, and

Roth IRA and 401k retirement

accounts. Regarding traditional IRA accounts and Roth IRA accounts, the

VeriPlan retirement calculators have fully automated the projection

of your lifetime IRA contributions, tax deductions, tax-advantaged

investment returns, portfolio withdrawals, and capital gains taxation.

When necessary, the VeriPlan financial software automatically assesses

federal early withdrawal penalties, which are supplied, and any state

early withdrawal penalty that you might provide.

Documentation:

All of VeriPlan's worksheets provide extensive and readily available documentation.

Systems Platform:

VeriPlan runs in a

standalone configuration on all Machintosh and Microsoft

Windows computers that have Microsoft Excel. Internet

connectivity will augment the

information available to you, but Internet connectivity is not

required. To operate, VeriPlan requires Microsoft Excel version 2002 or

any

later version.

License and Purchase Information:

VeriPlan

is licensed and is for the personal, non-commercial use by one (1)

household. The price of one personal, non-commercial end user

license for the most recent version of VeriPlan can be found on

our VeriPlan home page. California

residents will also pay sales tax.

All orders receive our full and unconditional 30-Day VeriPlan User

Satisfaction Guarantee. Purchase terms are subject to change

without notice at the sole

discretion of Lawrence Russell and Co.

Personal Finance Decision Tools:

VeriPlan provides 10 sophisticated and automated personal

finance

decision tools summarized in a separate document, “VeriPlan’s 10 Financial Planning

Tools and Financial Calculators.”

VeriPlan Is Simply The

Best

Personal Financial Planning Software

You Can Buy!