Quicken and VeriPlan Comparison Inflation

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Finance Planner

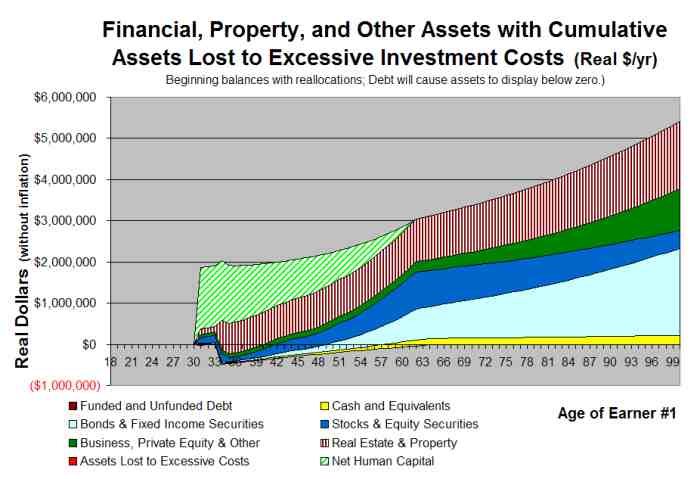

All VeriPlan projections extract inflation and use real or non-inflationary dollars with constant purchasing power across your lifecycle projection. For example, a dollar in a VeriPlan projection would have the same consumption buying power in fifty years as it has today.

In VeriPlan, whenever income, expenses, and other financial projection factors might be expected to grow at a rate different from average inflation, you can make growth rate adjustments. VeriPlan provides many more potential inflation adjustments than Quicken, because VeriPlan allows you to enter much more refined data.

Quicken Retirement Planner

Projected dollars in the Quicken Retirement Planner include a 3% inflation assumption. Similar to VeriPlan, the Quicken Retirement Planner allows you to make upward and downward inflation adjustments on the projection data that you enter. However, the Quicken Retirement Planner uses inflationary dollars and VeriPlan uses real or constant purchasing power dollars.

Because inflation is embedded in the Quicken Retirement Planner's total asset "Results: My Results" graphic, this graphic increasingly overstates future real dollar consumption buying power. There is no easy way mentally to scale back this data series to constant purchasing power dollars, because of the compounding of inflation over time is a geometric rather than a linear relationship. Above this graphic, the Quicken Retirement Planner lists a single number with the total current dollar value of your assets in the year when you retire, which apparently is deflated to the present by Quicken's 3% inflation assumption.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.