Quicken and VeriPlan Comparison Expenses and Savings

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Financial Expense Planner

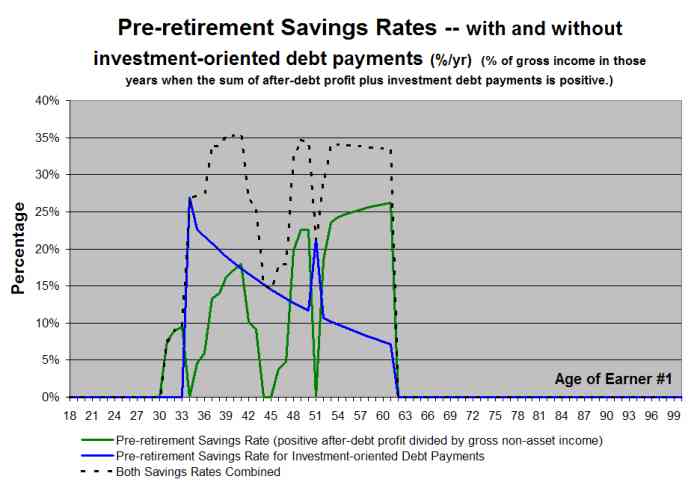

VeriPlan's Expense and Savings tool allows you to change your current expense levels and future expense growth rates. It also allows you to enter major planned expenses and their growth rates in any future year. You can enter positive and negative expense adjustments and growth rates for any projection year. VeriPlan fully automates the savings projection process and relates savings to annual net income after taxes and debt payments. (See: VeriPlan helps you to understand your lifetime personal savings requirements and whether you current savings rate is sufficient)

You need to enter you total current living expenses into VeriPlan, less your taxes and mortgage payments, which are managed elsewhere in VeriPlanautomatically. VeriPlan is not a current expense tracking application. VeriPlan assumes that you may already use some current expense tracking method, such as a personal spreadsheet or an expense tracking application like Quicken or MSMoney.

VeriPlan provides instructions on how to develop quickly an appropriate total measure of your annual living expenses from the information that you already have in your current expense tracking application. If you do not track your current expenses, you can simply use an annual estimate. However, VeriPlan will also strongly encourage you to begin some method of current expense tracking on a monthly or quarterly basis to increase your control over current savings.

Quicken Retirement Planner

The Quicken Retirement Planner provides some expense projection functionality that is similar to VeriPlan's. Because Quicken is an expense tracking application, the Quicken Retirement Planner has been integrated. To enter expenses into the Quicken Retirement Planner you can select from your current expense category details elsewhere in Quicken, or you can use a rough estimate of your current total annual expenses.

The Quicken Retirement Planner requires the user to set an arbitrary planned saving percentage, while VeriPlan fully automates this savings projection process. The Quicken Retirement Planner's expense and inflation adjustment data entry process uses a series of dialog boxes.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.