Quicken and VeriPlan Comparison Overview of Investments

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Investment Planner

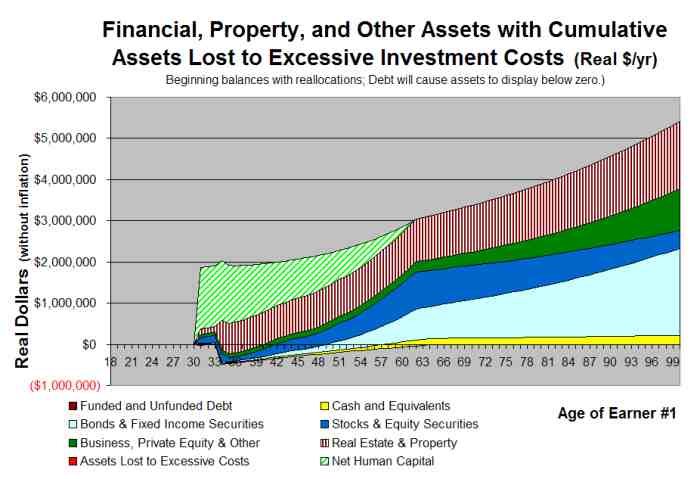

For each of your cash, bond, and stock financial asset holdings, VeriPlan separately and automatically projects annual returns and return variability based on long-term historical market averages and market volatility, which are supplied with VeriPlan. VeriPlan automatically projects your net annual holdings after taxes and investment costs by asset class, including new investments from future positive net earnings, reallocations, and withdrawals due to future negative net earnings. VeriPlan automatically assesses your overall annual net portfolio returns, tax-efficiency, and investment cost-efficiency. (See: VeriPlan helps you to understand the projected value of your cash assets across your lifecycle, VeriPlan helps you to understand the projected value of your bond and fixed income assets across your lifecycle, and VeriPlan helps you to understand the projected value of your stock and equity assets across your lifecycle)

VeriPlan can project these aggregates, even though the net valuation of your individual financial asset holdings may change at different rates due to return adjustments you make, varying investment costs, uneven taxable distributions, legal differences in taxability, and variations in tax rates. VeriPlan can provide significantly more personalized insight, because its projections focus on your particular projected financial lifecycle and do not rely, for example, an average tax assumption. In addition, VeriPlan will automatically project the value of your real estate, property, and other assets using your current fair market value estimates and rates of asset appreciation that you supply. (See: VeriPlan helps you to understand your projected lifecycle taxes in multiple categories on a year-by-year basis)

Individually and automatically, VeriPlan will manage separately up to 24 cash assets, 24 bond and fixed income assets, 99 stock and equity assets, 10 property and real estate assets, and 10 "other" assets.

Quicken Retirement Planner

The Quicken Retirement Planner combines your portfolio into a single investment asset category for its projections. The Quicken Retirement Planner maintains three projection accounts for your total investment assets: 1) total taxable assets, 2) your total tax-deferred assets, and 3) your spouse's total tax-deferred assets.

The Quicken Retirement Planner combines your current portfolio holdings into a single "Investment Assets" category. Then, it projects future values using this one aggregate. The Quicken Retirement Planner does, however, distinguish between your assets held in taxable and tax-deferred investment accounts, but Quicken does not seem to distinguish between traditional and Roth tax-advantaged accounts in the projection of your future taxes. Furthermore, Quicken's documentation states that all gains on tax-deferred assets are taxed at your average tax rate assumption.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.