Quicken and VeriPlan Comparison: Income

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Lifetime Income Planner

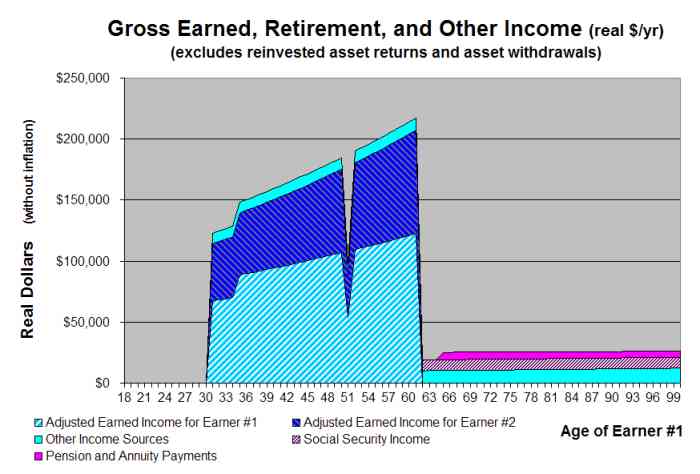

In VeriPlan, regular wage and salary employment income and self-employment income can be projected for either earner. VeriPlan's real dollar growth rates can be adjusted for any of these income sources. You can also enter information about other income sources that you have or that you expect to have in the future. Yearly adjustments for any projection can be made in VeriPlan's tables. Employment or self-managed business income can be earned even in retirement. VeriPlan fully automates the projection of personal income and other taxes associated with these income sources. (See: VeriPlan helps you to understand your projected lifecycle income from multiple sources)

Quicken Retirement Planner

The functionality of the Quicken Retirement Planner is similar to VeriPlan's, except that Quicken only uses average tax rates across all earned income and asset income sources. This results in after-tax projections that represent population averages, rather that comprehensive projections that are customized to the particular tax situation of an individual or family. Because income adjustments are done in tables in VeriPlan, data entry is more straightforward when compared to the Quicken Retirement Planner's various pop-up data entry boxes.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.