Quicken and VeriPlan Comparison Human Capital

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Financial Income Planner

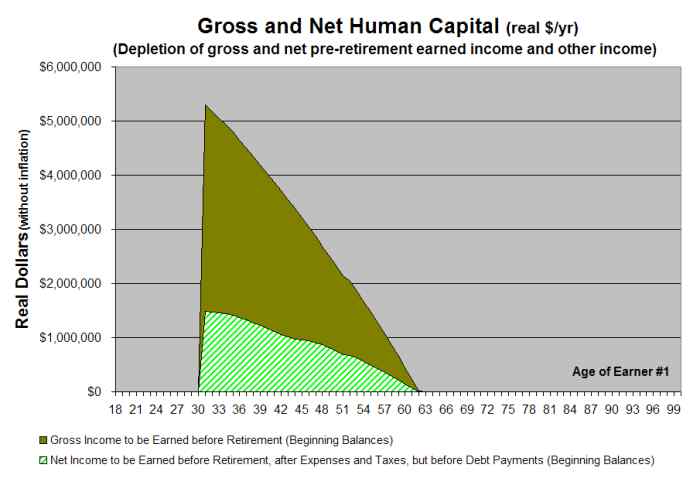

VeriPlan automatically projects your depletable, yet-to-be-earned “human capital.” Gross human capital is your cumulative, yet-to-be-earned total wage and salary income and self-managed business income. Gross human capital pays your ongoing living expenses before your retirement, and it provides the potential to save. (See: VeriPlan helps you to understand your projected lifecycle income from multiple sources)

Net human capital is your cumulative, yet-to-be-earned savings or your net income from your earnings after tax and debt payments. You must convert your net human capital into assets that can pay your living expenses after your human capital or your potential to earn is gone. Measuring human capital can be very helpful in understanding income risks, some of which may be insurable. (See: VeriPlan helps you to understand the lifecycle cost of insurance premium payments)

Quicken Retirement Planner

The Quicken Retirement Planner does not project your gross human capital or your net human capital.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.