Quicken and VeriPlan Comparison Investment Returns

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Investment Planner

VeriPlan's automated "centerline" projections are based on the very long-term, historical securities market rates of return that have been achieved in the cash, bond-fixed income, and stock-equity asset classes over approximately the past 75 years. Growth rates are fully user-adjustable using VeriPlan’s systematic and judgmental growth rate adjustment tools in VeriPlan's Portfolio Risk Tool. (See: VeriPlan helps you to project your future risk-adjusted investment returns in a scientific manner and VeriPlan helps you to align the risk and return of your financial portfolio with your relative tolerance for investment risk)

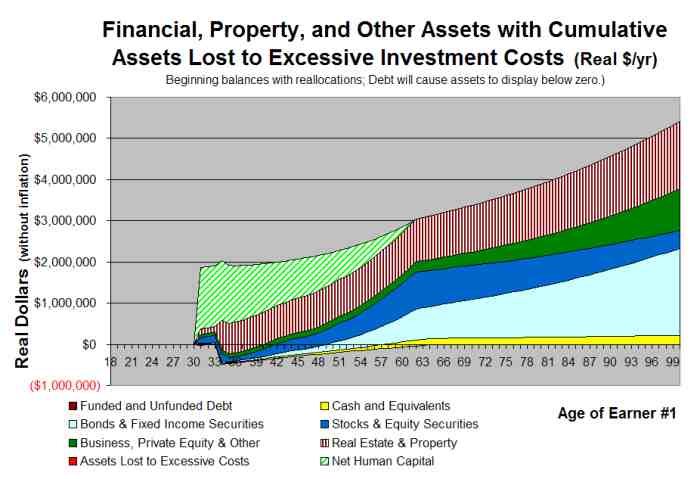

VeriPlan’s projections automatically deduct your taxes and investment costs from your financial asset class returns. Furthermore, across your lifecycle, VeriPlan will automatically project the value of your real estate, property, and other assets. VeriPlan uses the fair market value and future growth rate estimates that you provide for these real estate, property, and other assets.

Quicken Retirement Planner

The Quicken Retirement Planner provides very little guidance on investment returns and leaves up to the user the entire decision about appropriate estimates of future investment asset growth rates. In its documentation, Quicken explains that it aggregates all your investment accounts, because you cannot be assured that the rates of return you have achieved on any individual investment in the past would continue into the future. Then, in effect, the Quicken Retirement Planner throws the entire problem of choosing appropriate future investment planning rates of asset returns back on the user.

The Quicken Retirement Planner allows you to enter arbitrary total portfolio rates of return between 0% and 20% per year. It allows you to choose different rates of return for taxable and tax-deferred accounts before and after retirement. When compared with financial planning tools available to professional advisors, it would seem that Quicken has never heard of the scientific literature on historical risk free rates of return and asset class risk premiums.

While the future of investment returns is not predictable, the Quicken Retirement Planner has provided absolutely no standard for its users to judge their choice of investment returns. Quicken users are given very little information about whether the critical investment return assumptions they are using to develop their personal life financial plans are reasonable or fantastic in the light of securities market history.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.