Quicken and VeriPlan Comparison Investments Costs

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

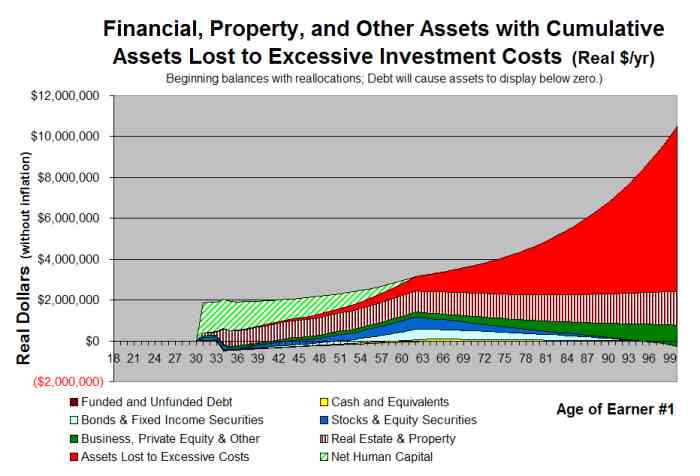

VeriPlan Financial Investment Cost Planner

Excessive investment costs are a huge problem for the average investor. VeriPlan's projections automatically analyze the impact of five types of investment expenses across your lifecycle: 1) purchase fees and loads, 2) management fees, 3) marketing fees, 4) transactions costs, and 5) account custody fees. VeriPlan fully automates the comparison of lifecycle investment costs between the investment costs of your current financial asset portfolio and the costs that you believe are reasonable to pay. (See: VeriPlan helps you to understand the full lifecycle cost to you of excessive investment expenses)

Quicken Retirement Planner

Because the Quicken Retirement Planner does not collect any information about your investment costs, it provides no measurement of your portfolio's future investment cost inefficiencies.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.