Quicken and VeriPlan Comparison Investment Portfolio Rebalancing

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

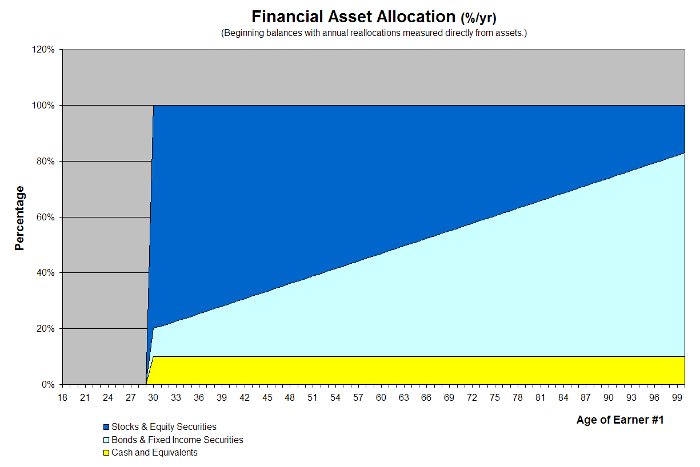

VeriPlan DIY Portfolio Rebalancing

The VeriPlan portfolio rebalancing software performs reallocations automatically at the beginning of all projection years starting at the beginning of the second year. VeriPlan leaves your current asset allocation untouched during the first year, so that you can clearly understand how your current portfolio asset allocation differs from your full lifecycle plan. This also allows you ample time to rebalance your assets in a cost-effective and tax-efficient manner. Of course, whenever you make changes to your real life portfolio during the first year and enter those changes into VeriPlan, they will be reflected automatically in your projections.

Quicken Retirement Planner

Because the Quicken Retirement Planner combines your portfolio into a single "Investment Assets" category, it cannot rebalance across asset classes.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.