Quicken and VeriPlan Comparison Retirement Overview

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Financial Retirement Planner

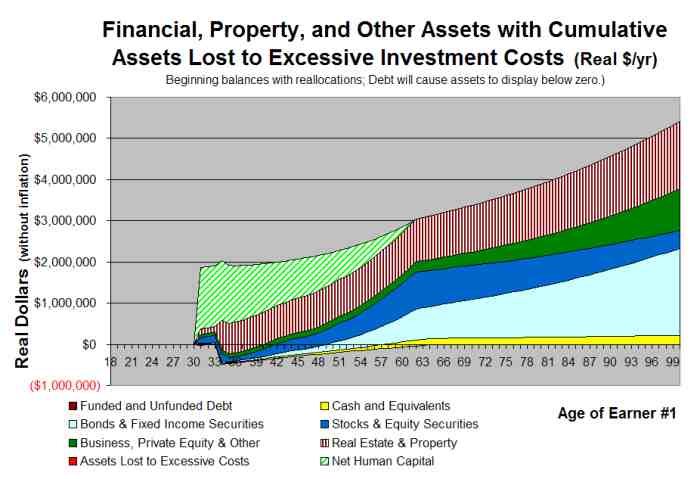

With VeriPlan's Retirement tool, you can set individual retirement ages for either earner. You can select whether or not to retire simultaneously. You can also adjust your expected ordinary living expenses in retirement and the growth rate of those expenses. Concerning Social Security retirement payments, you can set current levels of your entitlements and adjust the age at which you would first begin to receive Social Security payments.

Furthermore, VeriPlan allows you to scale back the amount of your projected Social Security payments, if you wish. Finally, because much older workers can face significant erosion of their real dollar wage rates, you can adjust VeriPlan's assumptions about real dollar wage erosion for earnings at ages over 65. (See: VeriPlan helps you to plan for your retirement)

Quicken Retirement Planner

The Quicken Retirement Planner provides the ability to set and change retirement ages. If you want to plan for simultaneous retirement when users are of different ages, this must be done manually. The Quicken Retirement Planner also can project and scale back estimated Social Security income in retirement. Quicken does not account for real dollar wage erosion for those who work past age 65.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.