Quicken and VeriPlan Comparison Portfolio Safety

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Investment Risk Planner

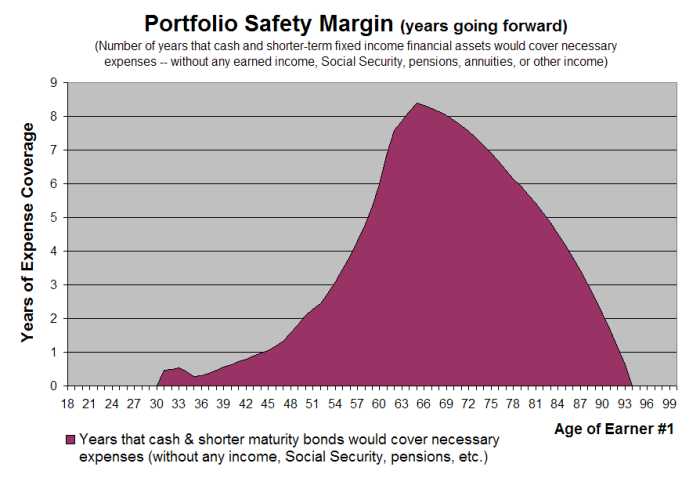

Individual investors face a significant dilemma. Both less risky and more risky investment strategies may not achieve desired results for different reasons. When assessing investment strategies with different risk levels, it can be very helpful to understand how the "safer" portion of your portfolio assets might evolve across your lifecycle.

VeriPlan's Portfolio Safety Tool automatically projects how long your cash and shorter-term fixed income assets would cover your projected expenses, if all your expected income sources ceased at any point. This tool automatically measures your projected financial capacity to weather future financial risks. (See: VeriPlan helps you to compare investment risk and return tradeoffs)

Quicken Retirement Planner

Because the Quicken Retirement Planner does not distinguish between asset classes in its projections, Quicken does not project separately the growth of your cash and bond assets in the future. Therefore, the Quicken Retirement Planner cannot give any indication of the projected expense coverage by your safer cash and bond assets.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.