VeriPlan Overview: Part 1 of 7

Improving personal finance decisions with VeriPlan

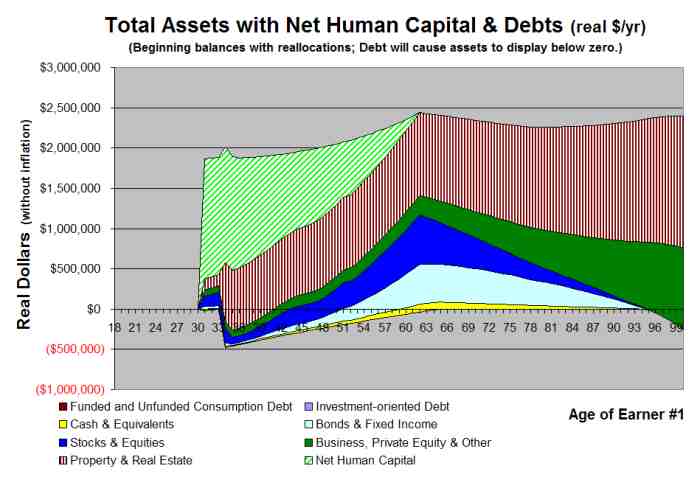

VeriPlan gives you significant personal insight into your most important personal finance and investment portfolio decisions. Through comprehensive and customized lifetime projections, VeriPlan’s integrated financial calculators and investment calculators model your particular financial situation across your adult lifetime. VeriPlan projects fully integrated scenarios about your income, expense budget, debts, investment portfolio assets, investment returns, and investment costs within the context of the U.S. federal, state, and local income taxes that apply to you. VeriPlan presents all your personal lifetime financial modeling information in clear graphics and data tables.

You can easily customize any of your personal data and settings in VeriPlan. After you make any modification, VeriPlan’s financial calculators and investment calculators automatically and instantaneously revise your complete lifetime projection. As you use VeriPlan’s rich set of fully integrated “what if” financial modeling tools, you take control of your own financial, investment, and retirement planning.

Personal Users: VeriPlan helps self-directed personal users to understand the possible future implications of current financial planning behaviors. VeriPlan projections model the lifetime finances of one or two adult users and their dependents. Any family member who resides in the same household may use VeriPlan.

Advisory Users: VeriPlan is a valuable tool for financial advisors who serve the fiduciary interests of their financial planning clients. Advisors can obtain a right-to-use VeriPlan on behalf of their clients, when they provide VeriPlan to their clients.

VeriPlan can help you to analyze important personal finance decisions, including:

Debt Management:

- What tradeoffs are associated with accelerating mortgage loan payments or other debt repayments?

Education Expenses:

- Will I be have enough college savings to pay for my children’s education?

Estate Planning:

- How could my savings rate and investment strategy affect the size of my estate?

- After my living expenses, how much could I give or bequeath to family and charities?

Insurance Budgeting:

- How large might my exposures to insurable financial risks be over time?

- How might different budgets for insurance premiums affect my lifecycle financial plan?

Investment Cost Reduction:

- What investment returns might I earn net of investment costs?

- How much could I waste on unproductive investment costs?

- How might I optimize my investment returns, while keeping costs to a minimum?

Investment Returns:

- How does my current investment strategy compare with a scientific strategy focused on long-term, risk-adjusted returns net of investment costs and capital gains tax?

Investment Risk Management:

- What returns might I expect from the balance of expected investment returns and investment risks that I have chosen?

- Am I saving enough to stay in my investment risk and return comfort zone and still reach my financial planning goals?

- If I were to lose income in the future, how long would my liquid investment portfolio assets cover my projected expense budget?

New Business Ventures:

- What are the likely long-term benefits and risks, if I fore-go current income to start a business?

- Could I self-fund my business venture or would I need external capital?

Personal Career Planning:

- What are the long-term economic benefits of changing positions or employers?

- Would returning to school to improve my career skills make economic sense?

- Could starting a business lead to both entrepreneurial and financial success?

Real Estate Planning:

- When will I have sufficient capital for a real estate purchase?

- How would increased mortgage debt affect my investment portfolio and other financial goals?

Retirement Planning:

- Would I have sufficient investment assets to retire early?

- Would my investment assets be adequate to cover my expenses, if I live a very long time?

- What is a relatively safe asset portfolio withdrawal plan?

Saving Goals:

- Am I saving at a sufficient rate to fund all our future financial planning goals?

- How much benefit might I expect from increasing my income and/or reducing my expense budget?

- What is the long-term value of saving most of my bonus?

Tax Reduction:

- Am I managing my investments from an income tax efficiency standpoint?

- How much should I put into either taxable, traditional retirement accounts, or Roth retirement accounts?

- Would my retirement portfolio assets be adequate after my income taxes and other taxes are paid?