Automatically project your lifetime and retirement federal, state, and local income taxes, capital gains taxes, property taxes, and other taxes

VeriPlan’s personal retirement tax calculator software automatically projects your real dollar tax obligations using current tax rates and tax limits that would apply in your particular situation. For example, regarding your income taxes and income tax rates, the VeriPlan investment and income tax planning software for individuals uses current marginal federal income tax rates after taking into account your projected tax deductions, exemptions, and adjustments.

Regarding state taxes and local income tax rates, VeriPlan’s tax projection software and tax calculator tools assess these taxes according to the marginal or flat tax rate method that applies in your tax jurisdiction. The VeriPlan pre- and post-retirement tax calculator automatically assesses Social Security taxes, Medicare taxes, self-employment taxes, real estate and property taxes, short-term capital gains taxes, and long-term capital gains taxes.

In addition, VeriPlan fully integrated IRA retirement calculator and 401k retirement calculator facilities automatically apply lifetime taxes related to your traditional IRA, 401k, 403b, 457, Simple, Keogh and other retirement accounts and to your Roth IRA and to your designated Roth 401k, Roth 403b, and Roth 457 account contributions.

The VeriPlan tax calculator software automatically applies variable U.S. federal income tax rates and limits. Current federal tax rates are included, and all tax rates and limits in VeriPlan are user changeable. VeriPlan provides and applies variable or flat income tax rates and limits for the 50 U.S. states and Washington, D.C. Furthermore, this retirement tax calculator software automatically projects any local variable or flat ordinary income tax rates according to the rates and limits that you supply. VeriPlan supports both the ‘Single’ and “Married, Filing Jointly’ tax filing statuses for your federal, state, and local income tax projections.

The VeriPlan tax calculator software projects your full lifetime taxes in annual increments in these eight separate tax categories:

- Federal income taxes on earned income, interest income, retirement income, and other income

- State income tax and local income taxes on earned income, interest income, retirement income, and other income

- Social Security and Medicare taxes on earnings, plus income taxes on Social Security payments in retirement

- Property and real estate taxes

- Federal income taxes on mandatory tax-deferred account withdrawals and on withdrawals to pay living expenses

- State income taxes and local income taxes on mandatory and needed tax-deferred account withdrawals

- Federal long-term capital gains taxes

- State income taxes and local ordinary income taxes on long-term capital gains

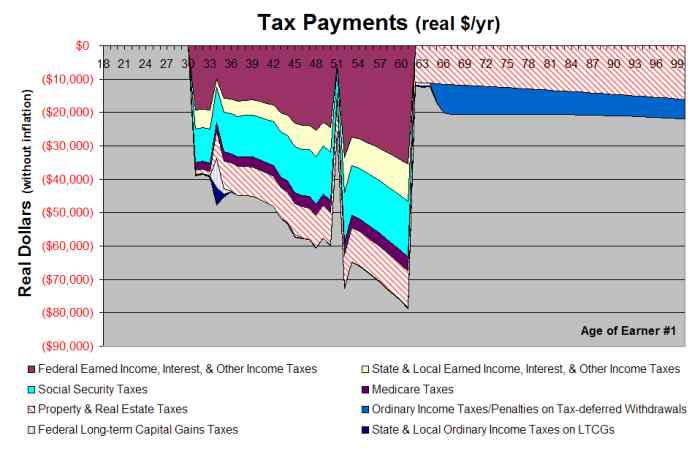

This is a sample of the VeriPlan lifetime tax planning software for individuals graphic that shows projected taxes in eight categories. This tax planning software graphic, like all other VeriPlan graphics, is automatically developed for each planning scenario that you develop in VeriPlan. (Note that this particular projection models a scenario wherein one of the earners in the family would be unemployed for six months at age 34 and for a full year at age 51. This projected loss of earned income significantly changes their projected tax obligations, and this accounts for the dramatic fluctuations in projected tax payments that you see in this retirement tax planning software for individuals projection graphic.)

VeriPlan’s income tax planning and tax calculator tools automatically project your full lifetime federal income tax deductions. In each projection year, it automatically applies the more favorable of either the standard deduction or your itemized deductions. The VeriPlan income tax calculator software projects your income tax exemptions for up to 10 dependents, and it manages income limited phase-outs of these tax exemptions. It also projects up to 6 different adjustments to your taxable federal income, and it manages associated differential income adjustment growth rates and phase-outs automatically.

The best investment and retirement fund federal, state, and local tax calculator software for individuals

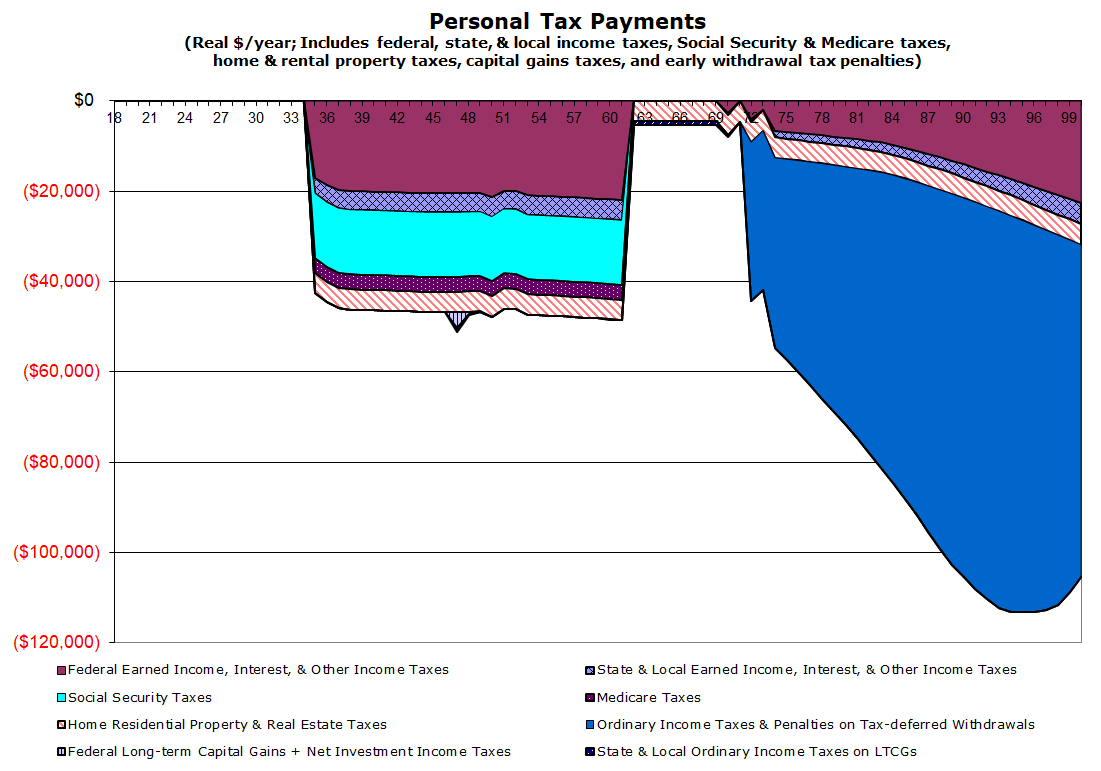

Here is another example that illustrates how the VeriPlan personal tax planning software can identify can be used as tax optimization software. In this situation, the user can visually identify a situation where a series of low income tax Roth conversions after early retirement might make sense to reduce income taxes on traditional IRA required minimum distributions after age 72.

VeriPlan Features Highlight:

Personal income tax planning calculator software for individuals

The VeriPlan consumer tax projection software automatically forecasts lifetime tax payments in these categories in the example above:

- Federal graduated income taxes (You can use current VeriPlan supplied federal income tax rates or enter your own user-adjusted rates.)

- State and local income taxes (50 state and District of Columbia rates are supplied and can be selected from a simple pull-down menu. Some people pay local income taxes as well. Current New York City local income tax rates are supplied or you can supply your own flat or graduated local income tax rates.)

- Social Security and Medicare taxes on earned income (FICA) (The VeriPlan income tax projection software automatically calculates Social Security and Medicare taxes on earned income and takes into account whether the income is from self-employment earnings.)

- Residential property and real estate taxes (VeriPlan will project real estate taxes on up to ten different properties.)

- Ordinary federal, state, and local income taxes and penalties on traditional tax-advantaged retirement accounts, including income taxes on Required Minimum Distributions (RMDs) (These ordinary income taxes on retirement account withdrawals are graphed in dark blue bar to distinguish them from federal, state, and local income taxes on other retirement income such as Social Security retirement payments. See the top maroon colored bars for federal income taxes and the cross-hatched light blue graphic bar after age 72.)

- Federal long-term capital gains (LTCG) taxes and net investment income taxes (NIIT) (For example, these are shown in the mid-40s, when some taxable LTCG assets must be sold for children’s college)

- State and local ordinary income taxes on long-term capital gains (LTCGs)

This VeriPlan personal early retirement tax calculator graphic illustrates early retirement at age 62 with substantial and increasing federal, state, and local ordinary income tax payments related to traditional retirement account RMDs later in retirement for this particular retiree. This is an opportunity to use the VeriPlan tax optimization software as a Roth IRA conversion calculator in Excel to do Roth conversion analysis and plan a series of low income tax Roth conversions after early retirement and before delayed Social Security retirement payments would begin at age 70 and RMDs would begin at age 73 or 75.

To prevent product obsolescence in the future, as you continue to use VeriPlan, you can change any tax rates and tax limits, in case tax laws, rates, and limits change in the future. There is no need to buy an updated version of the VeriPlan home financial planning and retirement tax planning spreadsheet software, because you can update it yourself.

Additional VeriPlan retirement tax calculator software features

VeriPlan automatically projects taxes associated with both employee and employer contributions up to legal maximums into 401(k), 403(b), 457, Thrift Savings, SIMPLE-IRA, and/or SEP-IRA plans. It directs pre-tax and after-tax contributions into traditional retirement accounts and/or Roth retirement accounts, as appropriate. Similarly, with VeriPlan you can control lifetime personal and spousal IRA contributions into traditional and/or Roth IRA retirement accounts. It is also a flexible 401k contribution and distribution tax calculator at retirement for federal, state, and local income taxes, as well as a tax calculator on pension income and annuities in retirement, as well as, a flexible deferred compensation tax calculator.

With VeriPlan you can analyze the long-term tax impacts of year-by-year Roth conversions informed by:

- projected federal marginal income tax rates,

- Social Security retirement benefit income taxation,

- Medicare IRMAA premium reductions, and

- asset tax location optimization.

VeriPlan clearly explains the lifetime economic and investment tradeoffs between traditional and Roth retirement account assets, so that you understand the proper comparison model

The VeriPlan federal income tax calculator for retirees automatically projects the tax effects associated with the SECURE Act “2.0’s” delay of initial RMD ages to 73 in 2023 and age 75 in 2033. It also allows you to differentiate spousal RMDs by age and asset ownership, since RMDs are calculated on an individual basis and can vary when there is an age difference between spouses.

VeriPlan automatic projects Social Security spousal benefits with parameters that you control. VeriPlan automatically determines the highest benefit based on either the individual’s work record or the spousal benefit, including early claiming reductions.

The VeriPlan retirement pension, annuity, and deferred compensation tax calculator provides flexible functionality for the projection modeling of your pension, annuity, and deferred compensation payouts in retirement. If you expect to have pension, annuity, and/or deferred compensation retirement income, you can enter payout information for each retirement income source. You can also control taxation of payments and direct payment deposits into taxable, traditional retirement, or Roth retirement accounts.

State level income taxation of Social Security retirement benefit income and traditional retirement withdrawals & RMDs

VeriPlan’s Taxes worksheet summarizes federal income taxation policies and exclusions related to Social Security income in retirement. All VeriPlan personal retirement tax software projections automatically implement these federal income taxation rules related to Social Security benefit income. In addition, VeriPlan automatically takes into account differences in state level income taxation of Social Security retirement benefit income and traditional retirement withdrawal & RMDs income.

Most states and localities do not tax Social Security retirement benefits. Only nine states tax Social Security retirement benefits and some of those states provide additional exclusions compared to income-related Social Security retirement benefit tax exclusions at the federal level. A section below provides information on these state level Social Security benefit tax reductions or exclusions.

Withdrawals from traditional tax-advantaged retirement accounts, including RMDs, are another potential source of state and local retirement taxation. The states vary in their taxation of traditional tax-advantaged retirement account withdrawals and RMDs, and VeriPlan projections manage these differences for you automatically.

A key thing to keep in mind is the total amount you will have accumulated in traditional retirement accounts by retirement and their potential appreciation thereafter. When a retiree has much higher total balances in these account, state level tax policies can make a difference. Also, retirement taxation of these withdrawals and RMDs is good reason to understand the concepts behind portfolio asset tax location optimization, which are discussed in detail within VeriPlan. Proper holdings with respect to differences in taxation of assets, can reduce lifetime taxes on traditional RMDs and other withdrawals.

Twelve states do not tax traditional retirement account withdrawals and RMDs. This is primarily because the majority of those states do not have a state income tax, but some of these states also intentionally do not tax traditional retirement plan withdrawals and RMDs.

Of the remaining states that do tax some portion of traditional retirement account withdrawals and RMDs, about twenty states offer some level of dollar exclusion from taxation on a per person basis — compared to the amount of traditional retirement withdrawals and RMD income taxed at the federal level. The remaining states do not offer any added exclusions, and they tax on the same adjusted gross income as federal levels. A handful of states may offer some per person dollar exclusion, but will claw back that exclusion at higher income levels using a phase out.

From year to year states may change their tax rules. Annually, near the beginning of the calendar year, the latest version of VeriPlan is updated for federal and state tax rule changes, including such changes have been made to state laws.

State level income taxation of Social Security retirement benefits — 50 States & DC

Most US states and the District of Columbia do NOT tax Social Security retirement benefit income, either because Social Security retirement income is intentionally excluded from state income taxation or because the state has no income tax. In effect, the nine remaining states that tax some portion of Social Security retirement income are Connecticut, Kansas, Minnesota, Missouri, Montana, New Mexico, Rhode Island, Utah, and Vermont.

Three additional states: Colorado, Nebraska, and West Virginia are sometimes found on lists of states that tax Social Security retirement benefits. However, recently these three states have either eliminated, will soon eliminate, or have effectively eliminated state income taxation on Social Security retirement benefits. Therefore, VeriPlan in its lifetime tax projections classifies these three states as no income tax states with respect to Social Security retirement benefits.

For these remaining nine states, VeriPlan’s lifetime projections limit the amount of Social Security retirement income subject to state taxation according their rules. For all remaining states and DC, Social security retirement income is fully excluded from state level taxation.

and, if you are one of the “lucky” persons who is also subject to a local income tax in addition to state income taxes, and you have made appropriate local income tax settings on VeriPlan’s Taxes worksheet, then VeriPlan will be assume that state level taxable income rules for Social Security benefits will also determine whether Social Security retirement income is taxed at the local level.

The nine taxing states below use adjusted gross income (AGI) exclusions for single filers and for married, filing jointly filers. Below these AGI limits Social Security retirement benefits usually are not taxed at the state level. Above these AGI dollar limits, the tax rules will vary by state — ranging from exclusions from as high as 75% down to 0% (no exclusion). VeriPlan’s projections will hand all of this automatically for you. If state tax rules have changed from when this article was written, then the annual update of VeriPlan in the early spring will include those changes.

- Connecticut: Single filers with AGI of less than $75,000 and married couples AGI below $100,000 do not pay state income taxes on Social Security benefits. 75 percent of benefits above those thresholds are tax-exempt.

- Kansas: Single and married filers with AGI up to $75,000 are exempt from state income taxes on Social Security benefits. Above that regular taxes apply.

- Minnesota: For 2022, single filers with AGI under $64,670 could exclude $4,260 of federally taxable Social security benefits. For married couples with AGI under $82,770 that exclusion was $5,450. These rather small exclusions phase out at higher incomes.

- Missouri: From age 62 onward a single filer with an AGI under $85,000 and married couples with AGI under $100,000 are exempt. When AGI is above these AGI thresholds, there is a partial deduction.

- Montana: Montana follows federal income rules, and taxes AGIs above $25,000 for a single filer and $32,000 for a couple.

- New Mexico: Taxes Social Security retirement income above an AGI of $100,000 for single filers and $150,000 for couples.

- Rhode Island: Taxes Social Security retirement income above an AGI of $95,800 for single filers and $119,750 for couples. AGI exclusions apply to those who have reached full retirement age of 66/67.

- Utah: The federal income calculation determines how much Social Security retirement income is taxable at the state level. Then, tax credits are used to reverse some state income taxation. AGI up to $37,000 for single filers and up to $62,000 for couples is effectively tax exempt. Above that 25% of Social Security income is excluded from taxation.

- Vermont: Taxes Social Security retirement income above an AGI of $50,000 for single filers and $65,000 for couples. There is a phase out for the next $10,000 of AGI, and the remainder is taxed at normal state tax rates.

State level income taxation of traditional retirement withdrawals & RMDs — 50 States & DC

The VeriPlan retirement fund and withdrawal tax calculator automates the projection of federal, state, and local level income taxation related to traditional retirement account withdrawals and RMD income taxation.

Some states are classified “no tax” states, because they intentionally do not tax traditional retirement plan withdrawals and RMDs. Some other states are “no tax” states simply do not have a state income tax. Of the states that do tax traditional retirement withdrawal and RMD income, some just follow the federal income taxation model. Other states will have exclusions and will not tax some dollar amount of the income on a per person basis. In addition, some states have minimum ages for qualifying for these exclusions. Furthermore, some states eliminate these exclusions, when federal Adjusted Gross Income (AGI) exceeds certain levels. (AGI is gross income BEFORE deductions or exemptions.)

Given the variety of state level approaches to taxing traditional retirement withdrawals and RMDs, the VeriPlan retirement distribution tax calculator uses this general model. States are classified as either as “taxing states” (Yes=1) or “no tax states” (No=0)

For retirement withdrawals and RMDs taxing states, regular income tax rates will be applied after applying any of these exclusions:

- How much is the state’s per person income exclusion, if any (zero dollars or higher)

- Is there a minimum age test to qualify for the exclusion? (zero or the minimum age for the exclusion)

- Is there an AGI threshold to eliminate the state’s exclusion for single tax filers? …for married, joint filers? (dollar threshold)

- If there is an AGI threshold, then any dollar exclusion will be phased out dollar for dollar above that threshold.

About twenty states offer some level of exclusion of income from taxation (#2 above) compared to the amount of traditional retirement withdrawals and RMD income taxed at the federal level. These exclusions are per person dollar exclusions rather than percentage exclusions. Regarding #3 and #4 above, only a handful of states will offer some dollar exclusion and then take it back at higher income levels with a claw back phase-out.

VeriPlan lets you analyze state and local tax differences, when you plan to move to another state for a job in the future or at retirement

Sometimes people living in higher income tax states think that, when they retire, they can save significantly on taxes by moving to another state. Other people might want to move to another state for a better paying career opportunity. In both situations, people want to understand the tax implications. The VeriPlan Move-States worksheet is powerful retirement tax planning software that can help you with your analysis.

For those planning to move once they retire, it could be true that they would save on state and local taxes in their new, move-to state. Often, however, that is not the case. Major mistakes can be made in this area. Residents of higher income tax states may benefit from higher incomes while working. They might just assume that retiring in a no income tax or low income tax state would obviously be more advantageous. However, in retirement when earned income goes away, taxation can shift in unfamiliar ways.

The primary reason is that once one retires, their income tax situation will change significantly. Those “high” state and local income taxes on earned income would go away and income in retirement that is subject to taxation could drop significantly. A person should do their due diligence research before planning a significant move to another state. VeriPlan’s state and local tax evaluation features can help you to determine whether the “tax grass” might indeed be greener in your move-to state.

Those considering a move to another state for a better, higher paying career opportunity can use VeriPlan’s Move-States tool to compare projected current state versus move-to state and local taxes for the remainder of their career and retirement. VeriPlan helps you to evaluate the taxation differences when moving from your current state of residence to another state at some point in the future. In that future moving year, VeriPlan’s projections will switch to the tax system of your move-to state. Thereafter, your projections will assess your “move-to” state taxes for the remainder of your life.

In addition, if you have been paying local income taxes in your current state of residence, those taxes would cease in our projections in the year that you move to your new state. If your move-to state has additional local tax levies, you can enter a fixed annual dollar amount and/or a flat percentage of income with exclusions below.

In addition, when one moves to another state, there obviously is a question about where to live and buying versus renting. During the move year to another state, you might want to enter moving expense and rental expenses in Section 3 of the Expenses worksheet. Regarding the purchase and sale of residential real estate in the future you should note that VeriPlan has automated this for you on the Property + Debt worksheet. It is also helpful to use VeriPlan’s Comparison Tool to compare differences between continuing to live in your current state versus moving to another state.

VeriPlan’s move-to-another-state functionality will automatically manage any state to state differences in the taxation of Social Security retirement benefit income and retirement withdrawals & RMD income. You can also change any of your “move-to” state’s parameters for taxing Social Security retirement benefit income and traditional retirement withdrawal and RMD income.