Quicken and VeriPlan Comparison Introduction and Overview

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Financial Spreadsheet Planner

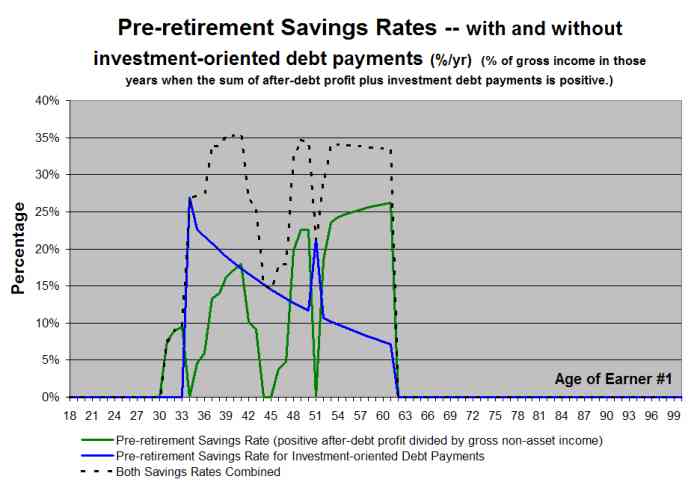

VeriPlan gives you significant personal insight into your most important financial and investment decisions. Through personalized, comprehensive, and customized lifecycle projections, VeriPlan models your particular financial situation across your adult lifecycle. VeriPlan is a lifecycle projection model for 1 or 2 users/earners from 18 to 100 years old. Projections can begin at age 18 to 99 and all projections continue through age 100.

VeriPlan projects fully integrated scenarios about your family's income, expenses, debts, assets, investment returns, and investment costs within the context of the U.S. federal, state, and local taxes that apply to you. VeriPlan’s integrated, automated, and high performance asset projection facilities enable the rapid evaluation of a wide range of customized financial plans. VeriPlan provides 10 sophisticated and automated personal financial decision tools for your personal use. VeriPlan's total assets graphics demonstrate whether your plan might succeed or fail. (See this VeriPlan Overview articles category)

Quicken Retirement Planner

Quicken's "Planning" pull-down menu provides a variety of planning calculators. Quicken's documentation states, "the Life Event Planners are important tools for helping you plan your financial future. They help you set goals for key life events such as retirement, buying a home, and sending your children to college. Then, they help you determine what financial decisions you need to make to reach those goals—for example, how much you need to save each month, and what rate of return you need from your investments."

The Quicken Retirement Planner models 1 or 2 users and uses a maximum 150-year lifespan. A plan starts with the current calendar year, and calendar years are used for the x-axis on the Quicken Retirement Planner's "My Plan" graphic. To relate this My Plan graphic to your ages, you will need to convert between calendar years an your future ages mentally, when you evaluate your projection.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.