A lifetime financial planning tool that helps you to save thousands of dollars annually

Summary: By giving you the information that you need to improve your personal financial planning and investing decisions, VeriPlan helps you to save thousands of dollars. You do not need to be wealthy for this to be true. More modest near-term savings can rapidly escalate into saving thousands of dollars annually in future years.

This personal finance article summarizes just a few of the many areas where VeriPlan could help you to save significant amounts of money over your lifetime. Each of the summaries below is brief, because VeriPlan's financial calculator capabilities are documented in other articles on The Skilled Investor website. To learn more, just follow the links that are supplied in the summaries below. Also, go to this webpage lists over twenty articles about "How VeriPlan Helps You To Plan Your Lifecycle Finances."

VeriPlan's financial software and integrated financial calculators help you to determine how much personal savings are needed to meet your financial goals across your lifecycle.

You cannot invest without savings. How much savings are enough for retirement planning and for all your personal budget requirements until then? ... too little? ... too much? Currently, the U.S. is experiencing a personal savings crisis. The national net personal savings rate is zero or slightly negative, despite a healthy and growing economy. This situation is a prescription for millions upon millions of future personal financial disasters. (See: Your personal earnings, expenditures, and savings are the most important determinants of your family’s long-term financial wealth and VeriPlan helps you to understand your lifetime personal savings requirements and whether you current savings rate is sufficient)

You do not have to participate in one of these looming personal financial planning train wrecks. You can choose to limit your current spending and consumption debt. You can pay off your debts and save at rates that will greatly enhance your future financial security.

VeriPlan cannot do the saving for you. That, of course, is your job. Nevertheless, VeriPlan can be extremely valuable to you, because can help you to understand how much you need to save. VeriPlan is a fully integrated, automated, and personalized financial calculator engine that helps you can test the lifetime effects of different personal savings rates. VeriPlan helps you to pierce the veil of your financial future to see how your current financial decisions may affect your future financial well-being.

Excessive investment expenses are a huge issue for individual investors.

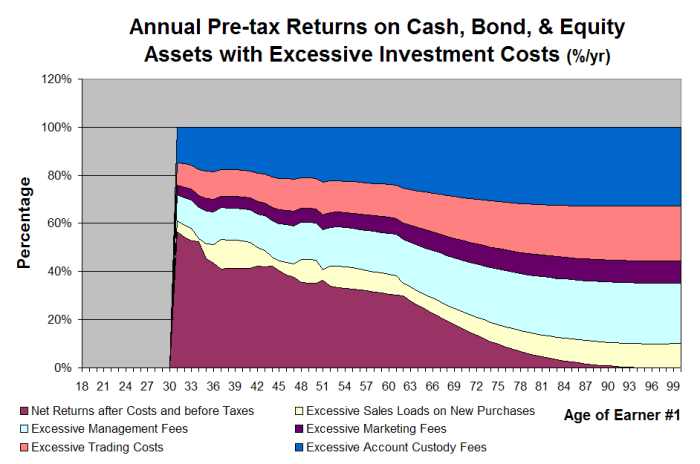

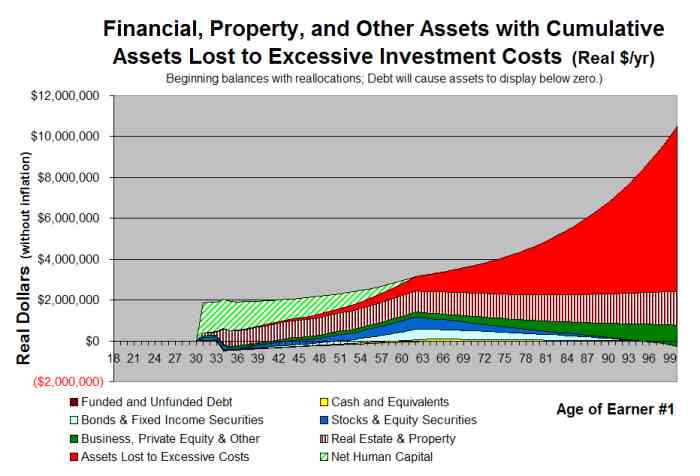

Year after year, millions of people lose large amounts of money on unnecessary and unproductive investment expenses. The typical investor loses about 2% of his or her investment portfolio assets every year by paying too much in investment costs and getting too little in return. This wasted 2% is not a percentage of your investment returns. It is a percentage of your financial assets -- money that is already yours. What right does anyone from the financial services industry have to a percentage of your investment assets every year, unless he or she actually contributes to growing your investment portfolio more than you pay out in fees and other costs? (See: Excessive investment costs are a huge problem for individual investors and The investment industry is not your investment partner)

VeriPlan's fully integrated investment calculator software helps you to improve your financial decision making related to investment portfolio expenses in two primary ways. First, you cannot decide to make changes, until you clearly recognize that there is a problem. Therefore, VeriPlan and The Skilled Investor website and blog educate you about the findings of the scientific investment research literature on investment costs. These findings are diametrically opposed to many of the things that the financial services industry tells you that you should do.

Implicitly or explicitly, the financial services industry tells you to spend more on their expensive services so that you get higher returns. On the contrary, the scientific finance literature tells you to spend less on investment fees and other expenses so that you can get higher investment returns. The scientific literature is right, and the financial services industry is wrong. However, most investors do not yet understand this. Investors keep paying excessive investment costs, and they keep getting suboptimal portfolio returns. (See: Passive individual investors are “free riders” who benefit from the higher costs of active traders)

Second, VeriPlan fully automates the financial modeling and analysis of your total lifecycle investment portfolio costs. VeriPlan's investment calculator functionality allows you easily to compare lifecycle financial plans that use either the investment cost characteristics of your current portfolio or alternate investment costs that you think are reasonable to pay. VeriPlan automatically measures your personal lifecycle costs for: 1) fees to buy investments (e.g. front-end purchase "loads"), 2) investment portfolio management fees (e.g. the management expense ratio), 3) investment marketing and sales fees (e.g. 12b-1 fees for investment funds), 4) securities trading costs (e.g. trading costs, which are indicated by rates of asset portfolio turnover), and 5) personal account custody fees, broker commissions, and advisory fees. (See: VeriPlan helps you to understand the full lifecycle cost to you of excessive investment expenses)

If your investment cost strategy is already highly efficient, then VeriPlan will demonstrate this to you. However, if you are like most individual investors, VeriPlan will quantify for you how much you would squander of your future financial well-being by continuing to pay excessive investment costs.

It is hard to overstate that excessive investment costs are such a serious issue to individuals. In VeriPlan, when you use its investment calculator functionality to compare a low cost investment strategy with an average investment cost strategy for a young middle-class professional couple, the differences in future cash, bond, and stock portfolio values are staggering. For example, leaving all other projection assumptions the same, a low cost investment strategy could lead to a million dollar financial asset estate at age 100, while paying average investment costs could lead to bankruptcy by age 90. Which road would you take?

VeriPlan starkly illustrates just how much you personally could waste on excessive investment fees. For this couple, the value difference exceeds $1,000,000 in current purchasing power dollars. That is not a bad return on such a bargain personal financial lifecycle planner!

VeriPlan helps you make more optimal decisions about the tradeoffs between investment risk, investment return, and personal savings.

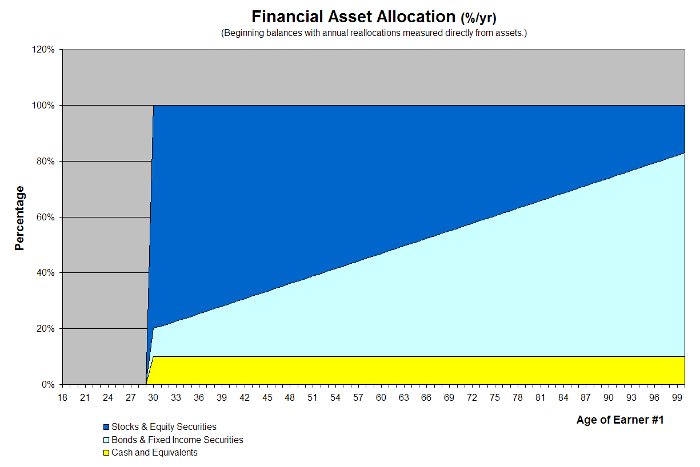

Too often decisions about risk-adjusted investing and asset allocation are over-simplified with a few questions about your risk tolerance. Typically, this superficial process will be followed quickly by the offer of a canned, off-the-shelf asset allocation scheme and the attempted sale of overly costly investments to fill in the blanks of the proposed asset allocation.

In this process, people have no idea whether their investment strategy combined with their savings rate, might lead to the future that they desire. Furthermore, most people do not fully appreciate the tradeoffs between investment returns, investment risk, and personal savings rates that are implicit in any proposed asset allocation. When someone asks you a few questions about risk and labels you a "conservative," "average," or "aggressive" investor, you have no real idea about what the proposed investment plan may require you to endure over your lifetime.

In contrast, VeriPlan puts you in the driver's seat by providing full control over assumptions about your income, expenses, debt, investment returns, and return variations or risk. VeriPlan provides five user adjustable asset allocation methods for you to experiment with, so that you can better understand the tradeoffs between different investment risk and return strategies. VeriPlan actually helps you to understand what it really means to be conservative or aggressive and how different asset allocations could affect necessary rates of savings and the variability of outcomes.

By allowing you to analyze these tradeoffs on your own PC, VeriPlan can save you a great deal of money in different ways. If you decide to take less investment risk, VeriPlan helps you to understand the required savings rate that would still meet your long-term goals. On the contrary, if you choose to take on greater investment risk, VeriPlan can help you to evaluate whether your current savings rate is higher than necessary and whether you could spend more money for current consumption. (See: VeriPlan helps you understand how your current savings rate affects your future financial goals)

VeriPlan allows you to analyze multiple personal financial decisions simultaneously.

Personal financial and investment decisions are complex, because so many different factors are in play simultaneously. When an integrated financial software application like VeriPlan is developed by people who understand scientific financial projection methods, all these different factors can be measured and automated on a modern personal computer. When the important, but gritty, details about your financial situation have been automated in the background, you can finally concentrate on evaluating alternative decisions. VeriPlan does exactly this for you. VeriPlan automates all significant financial factors that reasonably can be automated for you.

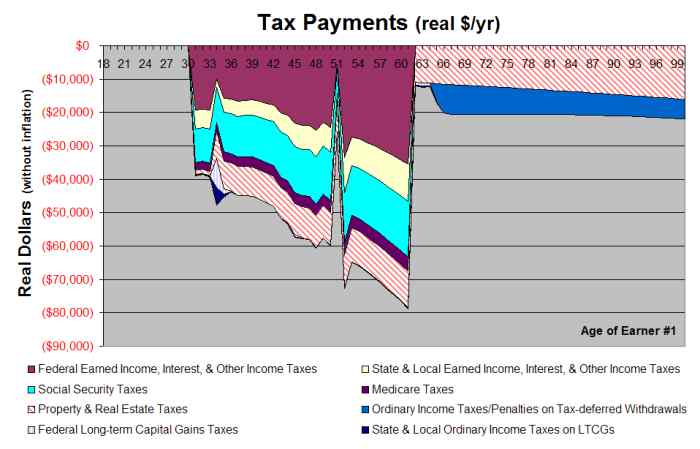

Because VeriPlan is fully integrated and fully automated, you can evaluate multiple financial decisions simultaneously. Unlike simplistic financial calculators, VeriPlan's integrated financial planning software reflects all of your personal financial information and investing plans. VeriPlan can simultaneously and instantly compute customized projections for you using hundreds of different settings for your income, assets, debts, taxes, pensions, annuities, real estate, investment strategies, investment risk, asset allocation, etc.

For example, you could change any or all of the following factors to understand multiple financial decisions simultaneously: 1) annual expenditures and rates of growth, 2) retirement ages, 3) plans to buy a first, second, or third house, 4) retirement contribution rates, 5) Roth plan contribution percentages, 6) sending multiple kids to private schools and college, 7) charitable contributions, 8) expected Social Security retirement payments, 9) financial asset allocations, 10) returning to school for mid-career education, 11) different investment costs, 12) different asset return rates varied upward or downward -- systematically or arbitrarily, 13) multiple annuities purchases, 14) different federal, state, and local income and other tax rates and limits, 15) acceleration of any or all debt repayments... etc. You could also make numerous other changes in addition to those listed above. (See: Executive Summary of VeriPlan and VeriPlan's 10 Personal Financial Decision Tools)

Hopefully, this makes the point that when we say that VeriPlan is fully integrated, we mean that it is fully integrated. VeriPlan is not a trivial retirement or college savings calculator that measures two or three variables and ignores everything else. VeriPlan will model as many financial details as you decide to throw at it. If you want to evaluate the lifecycle impact of being unemployed for six months twelve years in the future and also plan to take a cruise around the world every other year for twenty five years after you retire, VeriPlan will do this for you effortlessly. In addition, VeriPlan will simultaneously and automatically take all of your other personal financial factors into account for you when you make these changes. This is the kind of financial tool you really need to understand and plan for your future.

As a financial calculator and investment calculator, VeriPlan becomes increasingly valuable with the passage of time.

While VeriPlan is priced low to be a genuine bargain, and it is an even greater bargain, when you consider that VeriPlan has no built-in obsolescence and that it can be used productively for years. We have engineered VeriPlan, so that you can change and update its important assumptions yourself. You do not need to buy a new version every year to stay current.

Because of this, VeriPlan can become even more valuable with the passage of time. As you learn about how VeriPlan works and what it can do for you, you can also update any of your personal income, expense, debt, tax, asset and other information in VeriPlan. For example, if federal, state, or local income tax rates and income tax limits change in the future, you can just change them in VeriPlan by yourself. You do not need to buy a new release to stay current.

Given the importance of doing better at personal financial planning, it really does not take much to pay back the bargain cost of VeriPlan. Just one slightly improved decision regarding an investment purchase could repay the cost of VeriPlan many times over. When you consider that you can keep using and updating VeriPlan over the years, then a very good bargain becomes an incredible bargain. Learn about VeriPlan here.