Quicken and VeriPlan Comparison Financial Decision Tools

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Financial Decision Planner

VeriPlan

provides 10 sophisticated, integrated, and automated personal financial

decision

tools for your personal use. The names of these tools are

listed below,

and these are described under other headings of this VeriPlan and

Quicken comparison:

* Asset Allocation Tool

* Expense and Savings Tool

* Future Debt Tool

* Future Home Purchase Tool

* Historical Asset Class Returns

* Investment Cost-Effectiveness Tool

* Portfolio Risk Tool

* Portfolio Safety Tool

* Retirement Tool

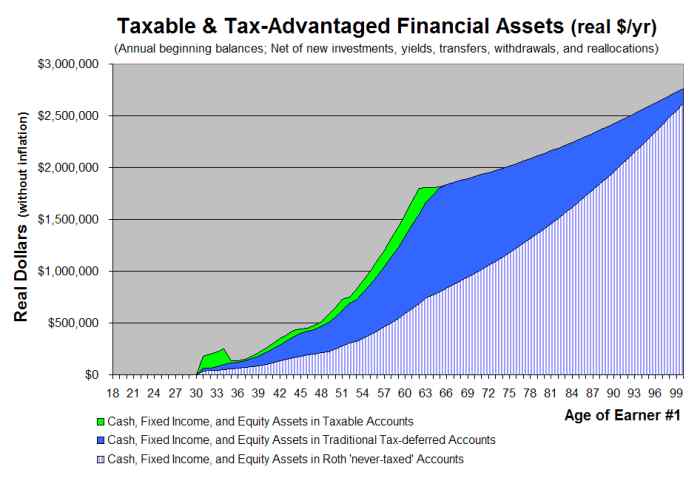

* Tax-advantaged Plan Tool

Quicken Retirement Planner

The Quicken Retirement Planner provides a "What if" pop-up window that allows you to select and change your retirement planning inputs and assumptions. The Quicken Retirement Planner also provides a red/yellow/green traffic stop light symbol to indicate whether your plan "succeeds" or "fails." Failure means that your assets are depleted at some point during your plan. Quicken also provides other financial calculators in single pop-up windows for college, loans, refinancing, retirement, and savings analysis in single pop-up windows that are not integrated into the Quicken Retirement Planner.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.