Quicken and VeriPlan Comparison: Real Estate and Property Tax

In this series of short personal finance articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Real Estate and Property Tax Planner

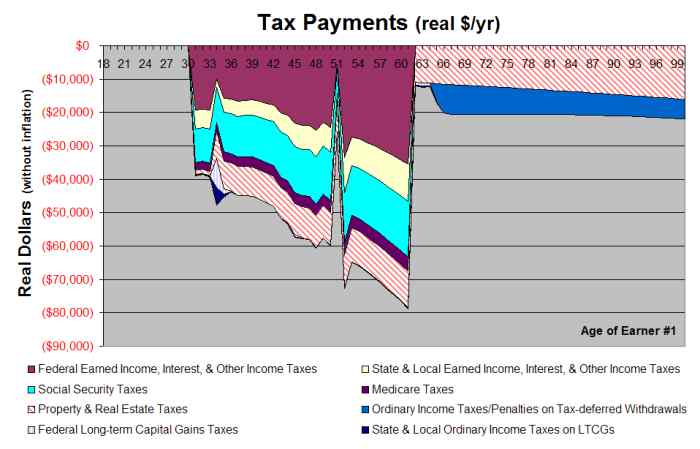

VeriPlan is a sophisticated and automated personal financial planner that includes a fully integrated real estate tax calculator, which projects your real estate and property taxes across you full lifecycle. VeriPlan's personal financial modeling software projects your lifetime real estate taxes plus seven other categories of personal taxes. It automatically projects your total annual property taxes, real estate taxes, and other property assessment taxes. (See: VeriPlan projects your US federal state and local lifecycle taxes)

VeriPlan automatically develops lifetime projections of your real dollar property tax obligations using the current taxation method that would apply in your particular situation. You can set your property tax rates on a property by property basis and decide whether these taxes are expected to grow below, above, or at the rate of property asset appreciation. In addition, VeriPlan's property tax calculator is fully integrated with VeriPlan's personal income tax calculator, debt and mortgage calculator, investment calculator, consumption debt calculator, and other projection planning functionality.

For example, VeriPlan automatically projects your real estate taxes and takes into account their impact on your personal income tax deductions and on your federal, state, and local personal income tax rates and payments. It automatically takes into account the payoff of your mortgage and the deductability of mortage interest and line of credit interest payments. It will project these tax factors automatically for homes that you already own and that you plan to purchase in the future.

Quicken Retirement Planner

In the Quicken Retirement Planner, real estate and property taxes can be projected as an annual percentage cost against the projected inflated asset value of each asset. This tax model would be appropriate in states and localities where property taxes will automatically escalate every year in proportion to the inflated asset value of a property. In California, for example, this model would be inappropriate because Proposition 13 grows property tax rates proportional to consumer price inflation limited to two percent annually rather than increasing taxes at the rate of price inflation for residential real estate.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.