Quicken and VeriPlan Comparison: Current and Future Debts

In this series of short articles, The Skilled Investor compares the functionality of the Quicken and VeriPlan financial lifecycle planners. At the bottom of this article you will find links to the previous topic and the next topic. A link is also provided that returns you to the main topic listing of this comparison.*

VeriPlan Personal Financial Lifecycle Planner

Regarding any current debts that you have, VeriPlan automatically repays interest and principal on up to 25 debts that you specify. All your debts are entered into a single spreadsheet in VeriPlan. You can plan for the accelerated repayment of any or all debts. Interest on certain debts, such as mortgages and real estate lines of credit, can be listed as tax-deductible and contribute to your projected itemized deductions. You can use these VeriPlan debt management facilities to develop a debt reduction plan. (See: VeriPlan helps you to decide whether accelerated mortgage debt and other debt repayment makes sense for you)

VeriPlan automatically manages mortgages on your planned purchases of up to three homes in the future. (See: VeriPlan helps you to plan financially for buying a home in the future)

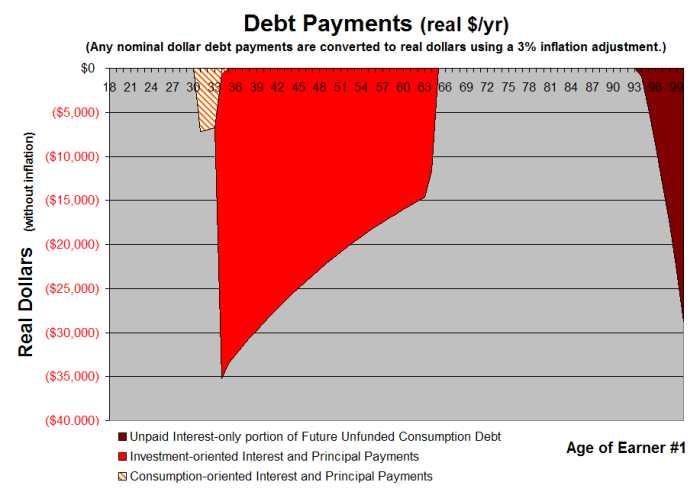

Excess consumption and the cost of debt can be very destructive to your family. The VeriPlan Future Debt tool allows you to set a debt interest rate for future unfunded consumption. VeriPlan automatically accumulates debt with unpaid interest, when your projected expenses exceed your projected income after your cash, bond-fixed income, and stock-equity financial assets are depleted. Subsequently, if positive net income becomes available, VeriPlan will automatically retire some or all of this unfunded consumption debt. (See: VeriPlan helps you to understand the true danger of consumer debt)

The VeriPlan Future Debt Tool functions much like a home equity line of credit that remains unused until needed and is repaid automatically when possible -- without requiring the sale of any assets. Some projected income shortfalls are temporary and can be bridged with borrowing rather than by the sale of assets that you may not wish to sell. Future sale of your assets might still be possible, but that is a decision that you could make, when the time came.

Quicken Retirement Planner

Different kinds of debts can be entered in different places within Quicken, including the Quicken Debt Reduction Planner, the Quicken Retirement Planner, and elsewhere in Quicken. Once you find these data entry points, you can do things that are similar to VeriPlan. Quicken's Debt Reduction Planner on the Planning pull-down menu allows you to schedule accelerated debt payoffs.

However, the Quicken Debt Reduction Planner forces you to follow a series of steps, which may include the mandatory viewing of videos that must load from the Quicken CD. These simplistic videos, for example provide obvious insights, such paying off high interest rate debts first. For sophisticated users, this tool might become irritating to use.

There are two ways to avoid these mandatory Quicken Debt Reduction Planner videos. First, if you remove the Quicken CD from your CD drive, the Quicken Debt Reduction Planner will tell you to load the CD. However, if you ignore this directive and do not load the CD, then you will be able to skip to the next step. Second, if you do load the Quicken CD, the Quicken Debt Reduction Planner will force you to watch the videos. However, by using your mouse or other pointing device to pull the video progress indicator forward, you can skip to the end of the videos and then move on to the next step of the Quicken Debt Reduction Planner.

The Quicken Retirement Planner does not offer an automated future borrowing mechanism for mortgage debts. Quicken will allow you to make manual entries of future mortgage debts using pop-up data entry forms.

Quicken does not have an automated future debt tool. If the Quicken Retirement Planner indicates that your plan would fail temporarily, you must manually enter a future debt, sell an asset, or change another assumption to make your plan "work." This would solve the problem with the current set of assumptions that you are using. However, if you manually enter a plan to take out a specific future loan and then you change another assumption that would obviate the need for this debt the Quicken Retirement Planner would not automatically eliminate this now unnecessary future debt, as VeriPlan would. This unnecessary future debt would remain, until you notice that it is still in the Quicken Retirement Planner, and you remove it manually.

<< Previous Topic* Lawrence Russell and Company is the publisher of The Skilled Investor and the developer of VeriPlan. The Skilled Investor has made an attempt to characterize factually the functionality of both the Quicken Retirement Planner and VeriPlan.

VeriPlan Is Simply The Best

Personal Debt Software

You Can Buy!