Plan for your best low tax rate years to do Roth conversions

Roth conversion analysis is the last thing that you should do when developing a do-it-yourself lifetime financial plan in VeriPlan. Roth conversion decisions are a tax-optimization of your final plan. Other decisions you make while building your lifetime financial plan will affect the financial rationale for or against converting to Roth assets. Therefore, make your other financial planning decisions first and incorporate them into your projection spreadsheet model. Then, use the best Roth conversion calculator in Excel to analyze your lifetime financial plan to understand whether Roth conversions make sense for you.

The projected tax breakeven age on your Roth conversions is what determines when and if you should do them. The following is a brief summary of the breakeven investment model on Roth conversions. I have written a more detailed article that you should also read, which discusses the economic and tradeoffs between Roth contributions and tax deductible traditional retirement account contributions.

This other article has more detail about comparing the breakeven model for Roth contributions made while working to Roth conversions in and after retirement. This is a summary investment model graphic that you will find in this other article.

The financial payback on the incremental tax payments on Roth 401k, Roth IRA, and other types of Roth account conversions and contributions can only begin with lower RMD taxes. Currently, RMDs start at age 73, which was implemented with the SECURE Act (“2.0”) of 2022. The SECURE Act of 2022 also has a provision for RMDs to begin even later at age 75 starting in 2033. VeriPlan calculates that anyone who reaches 73 before 2033 would be subject to RMDs at 73 rather than 75.

The value of the initial tax reduction from deductible traditional retirement contributions while working and the growth on those tax savings can be substantial. That is the investment hurdle that Roth contributions while working and/or lower tax Roth conversions in retirement must overcome. In many if not most circumstances, the break-even point on Roth contributions while working in the payback period would significantly exceed normal life expectancies. You may be more likely to die, before you have recouped your losses from paying higher taxes up front on Roth contributions.

Therefore, the projected age at which you would have broken even financially on Roth contributions and/or conversions is the key decision variable. Once you reach that break even point, the tax conversion advantage will begin to accrue. The longer you live, the higher the cumulative value of the payback on any particular Roth conversion.

Individuals may vary on how they would judge their preferred breakeven age. A single person with no heirs in poor health might desire a lower breakeven age. A married couple with good health and longevity in their families might be willing to accept a much later breakeven age. This is especially true, if they want to pass assets to children and prefer to leave Roth assets that would not increase the taxes of adult children who could be in their peak earnings years, when inheritance occurs. When you have a legacy objective to leave assets to non-spousal heirs, it would be highly preferable from a taxation standpoint to leave Roth account assets to non-spousal heirs rather than traditional retirement account assets.

Under the SECURE Act (“1.0”) of 2019, the inheritance period for retirement account assets was shortened to 10 years for non-spousal heirs. Whether the non-spousal heir receives traditional or Roth retirement assets, the assets inherited plus any subsequent asset appreciation must be removed from inherited account within 10 years. Heirs would not pay any taxes for these assets, if they are Roth assets. However, if these inherited assets are traditional retirement assets, they would be subject to federal, state, and local income taxes upon removal from the inherited traditional account during this ten year period. Incidentally, only traditional retirement accounts inherited by a spouse can be converted partially or fully into Roth assets — not those inherited by a non-spouse.

Another factor affecting the judgment of a couple about an appropriate breakeven age is the uncertainty of when one of them might be first to die. For married couples, should one partner pre-decease the other, the surviving spouse will normally inherit the traditional retirement IRA accounts and other traditional employer defined contribution plan (401k, 403b, 457, etc.) accounts. Surviving spouses are not subject the 10 year distribution period discussed above.

Instead, for inherited traditional retirement account assets, the spousal heir is subject to combined RMDs and associated income taxation for the remainder of his or her natural life. If the surviving spouse remains single, especially for many years, he or she will pay income taxes as a single person. The graduated income tax brackets for single persons move up more quickly when compared to the married filing jointly federal tax filing status of married couples. Income taxes on RMDs could increase significantly, and this situation would reduce the breakeven age for Roth conversions.

How to use VeriPlan’s year-by-year Roth conversion calculator planning tool

VeriPlan’s Roth conversion calculator tool helps you to understand which years in the future might be better to do Roth conversions, and it helps you to judge the federal tax rates on the amount of Roth conversions you plan to make in each year. Depending upon the year-by-year Roth conversion calculator amounts that you enter into VeriPlan’s Roth conversion Excel spreadsheet, it will automatically assess federal, state, and or local income taxes in you projections. Any state or local income taxes would be in addition to the federal income tax information provided below.

While it is not feasible to present information here about your state income taxes and local income taxes, when applicable, understand that the VeriPlan Roth conversion calculator automatically takes your state and local income taxes into account in these calculations. State income tax and local income tax rates and limits are not standard and vary widely. Nevertheless, when your projected federal income would be lower and federal tax rates would be lower, state and local income tax rates also tend to be correspondingly low. (You can look at your state income tax rates on the yellow-tabbed “Taxes” worksheet. The incremental state and local income taxes to be paid are indicated on the orange-tabbed “Plans Compared” worksheet, if you use the VeriPlan Comparison Tool method discussed below.)

Graphics in this article illustrate Roth conversions on a financial plan with the following parameters:

- A high income ($200k) married couple of the same age (60) who plan to retire at 65.

- Both have Social Security work records. One will claim at 70 and the other at 67.

- Given their current ages of 60, traditional RMDs would start at age 75 for both, which would be the beginning of the tax payback period on any Roth conversions

- About $1.4M of their current total of $2.3M in cash, bond, and stock financial assets are in traditional retirement assets. The remainder is in taxable accounts. They have no Roth assets currently. By age 75, their traditional retirement asset balance is projected to increase to $1.8M.

- They intend to optimize their current portfolio for “asset tax location” (see below)

- They plan a 12 year series of annual Roth conversions totaling $853,000 from ages 65 to 76 that would each be taxed each year no greater than 12% at the federal income tax level. For simplicity, they live in Michigan, a state that has 4.25% flat income tax rate. Michigan does not tax Social Security retirement benefits, but it does tax RMDs and other withdrawals from traditional retirement accounts, which VeriPlan implements automatically.

- Their overall breakeven age for this series of Roth conversions as between age 90 and 91. That age is fine with them, since they have longevity in their families and they have three adult children with good careers, who would appreciate it if their inherited retirement accounts would not be taxed during the ten year inheritance holding period. The cumulative added value of doing this series of Roth conversions is projected to be $307,000 by age 100.

Plan year-by-year traditional asset conversions into Roth retirement accounts — depending upon other projected taxable ordinary income

Your Roth conversion strategy should always be aware of incremental federal income tax rates and the dollars available within those brackets. VeriPlan’s year-by-year Roth conversion calculator Excel spreadsheet planning table provides this information. VeriPlan allows you to test various alternative plans for future Roth conversions and then choose the plan that is right for you. As a first step, a user might test the breakeven age on a single year future Roth conversion.

For example, VeriPlan might project that at age 69, the user could convert $90,000 of traditional retirement assets to Roth assets and still stay within the 12% federal income tax bracket for that year. Then, VeriPlan’s comparison tool could be used to check the breakeven age and decide whether doing any Roth conversions makes sense. If conversion does look appealing, then the user can make addition entries in other years, until a multi-year conversion plan has been developed. There are diminishing returns to additional Roth conversions and additional Roth conversions will push out the breakeven age. The VeriPlan Comparison Tool makes this easy to evaluate.

In this multi-year Roth conversion calculator illustration above, this couple has iteratively entered a series of Roth conversion amounts in column D, that are designed to “soak up” almost all of the dollars that are projected to be available up to the federal income tax rate of 12% shown in column G above. In this analysis, one does not need to plan to convert every last dollar available in column G. In this case, this could entered amounts to the nearest thousand that would leave under $1,000 in column G. The point is to plan for a series of annual Roth conversions and then judge the overall break even age, which will be discussed below.

Columns A and B are the Projection Year number and the corresponding age of Earner #1. Column C is the annual projected beginning balance of total traditional tax-deferred retirement assets subject to RMDs in retirement.

Note that other transactions automatically implemented by VeriPlan may affect the balances in Column C from year to year, including:

- automatic contributions to IRAs and work retirement plans during working years

- automatic withdrawals for RMDs — age 73 and after (or 75 and after beginning in 2033)

- withdrawals to cover negative cash flow, when projected taxable asset accounts have been exhausted

- annual cash, bond, and stock investment returns

- time lags between different variables can also affect transactions

Column D is the gray user entry column that allows you to choose positive dollar amounts to convert in one or more projection years. If you enter any dollar amount in Column D, the amounts in Columns E through K will immediately adjust, if they are affected.

The dollar amount to be converted cannot exceed the Beginning Balance (Column C)

- Cells will turn red if you enter a number in Column D that exceeds the value in Column C

- If a number larger than Column C is entered, the Roth conversion will be limited to available assets

- Cells will turn red if you enter a number in Column D when Column C says “Over Age 100

Column E is your annual projected federal taxable income ($ AGI less any standard or itemized deductions and dependent exemptions.)

- It is possible to have negative taxable income, which displays as red negative dollar amounts in parentheses. Negative numbers would occur when taxable income is below your standard deduction or itemized deductions plus any dependent exemptions. These negative amounts are the lowest hanging fruit for Roth conversions, because these amounts can be converted without paying any federal income taxes — a lost opportunity, if you do not do a Roth conversion in those years.

The amount listed above the column letter in Columns F through K is the dollar amount of the federal taxable income breakpoint, which varies depending upon whether your VeriPlan model is for filing federal income taxes as a single person or as a married couple filing jointly.

- Column F is the projected remaining income that you could convert at the 10% federal income tax rate

- Column G is the projected remaining income that you could convert at the 12% federal income tax rate.

- Pay attention, in particular, to columns F and G. Combined this is the projected annual dollar amount that could be converted at 10% or 12% federal income tax rates (+ any state and local income taxes)

When you do not have projected assets in taxable accounts to pay the incremental federal, state, and local Roth conversion income taxes, the VeriPlan Roth conversion calculator will automatically take out funds from your traditional tax-advantaged accounts to cover these tax payments.

The graphic below shows the remaining federal income tax bracket columns in VeriPlan’s annual Roth conversion calculator analysis tool should you wish to convert at higher tax rates.

- Column H is the projected remaining income that you could convert at the 22% federal income tax rate.

- Column I is the projected remaining income that you could convert at the 24% federal income tax rate.

- Column J is the projected remaining income that you could convert at the 32% federal income tax rate.

- Column K is the projected remaining income that you could convert at the 35% federal income tax rate.

- Any dollars converted in a given year above the amounts in column K would convert at the highest 37% federal income tax rate.

VeriPlan’s Comparison Tool allows you to understand the overall financial breakeven point on your Roth conversion calculator plan.

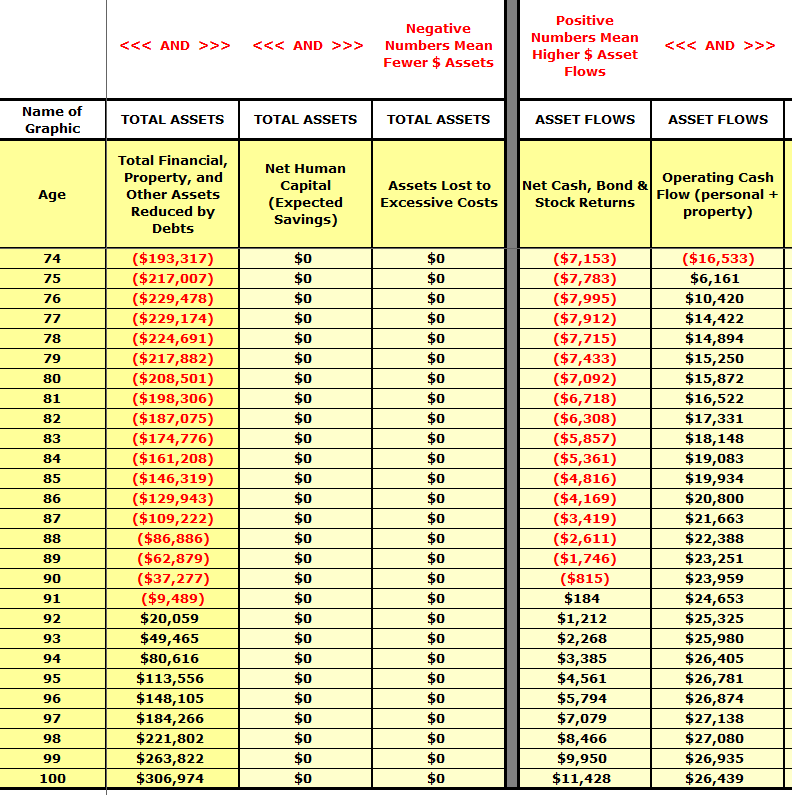

The graphic below was presents projected total assets from ages 74 to 100. There are many columns on VeriPlan’s Comparison Tool worksheet, so I simply scrolled horizontally to align the total assets column with the fixed age column. The total assets column shows that breakeven is achieved at about age 91 and thereafter the advantage to implementing this particular Roth conversion plan would be about $307,000 by age 100. Total assets at age 76 to 77 peak in negativity at around minus $229,000 which is the cumulative taxes paid on Roth conversions and the cumulative loss of investment returns related to the Roth conversion tax payments.

The two Asset Flows columns are also helpful in understanding what happens with Roth conversions. The Net Cash, Bond, and Stock Returns column is negative or red up through age 90, but one can see that the negativity diminishes steadily. This measures the investment return on the asset base. The Operating Cash Flow column is also instructive, because it shows the net payback over time from age 75 through 100. This illustrates the increasing advantage from owning reduced assets in traditional retirement accounts and thus having lower RMDs and lower taxes because of those lower RMDs.

How to use VeriPlan’s Comparison Tool to evaluate the breakeven age for Roth contributions and conversions:

- Before making any Roth contribution or conversion settings on VeriPlan’s Roth Analysis worksheet, set up VeriPlan’s Plan Comparison Tool.

- Read the orange-tabbed “How to Compare” worksheet to understand how VeriPlan’s Plan Comparison Tool works. Copy all of your final plan’s output data on the “Copy From” worksheet into VeriPlan’s “Paste Values To” worksheet.

- On the “Plans Compared” worksheet, scroll to the Total Assets columns and down to display Age 100 at the very bottom. If it is open, double click any Excel tab at the top of the screen to minimize the Excel “ribbon.” On a desktop display, you should be able to see ages 70 to 100 without vertical scrolling.

- Now come back to this Roth Analysis worksheet and enter one or more year-by-year Roth dollar conversion amounts

- Refer to the “Plans Compared” worksheet to see the age at which the Total Assets column turns from negative red numbers in parentheses to black positive numbers. This will indicate the projected breakeven age where the initial foregone tax deduction and subsequent appreciation would have been recovered in real dollar, constant purchasing power terms.

- This comparative breakeven age method will help you to determine, iteratively, what the optimum Roth strategy might be for your financial plan.

Roth Conversion Analysis, Asset Tax Location, Social Security Retirement Benefit Taxation, and Medicare IRMAA

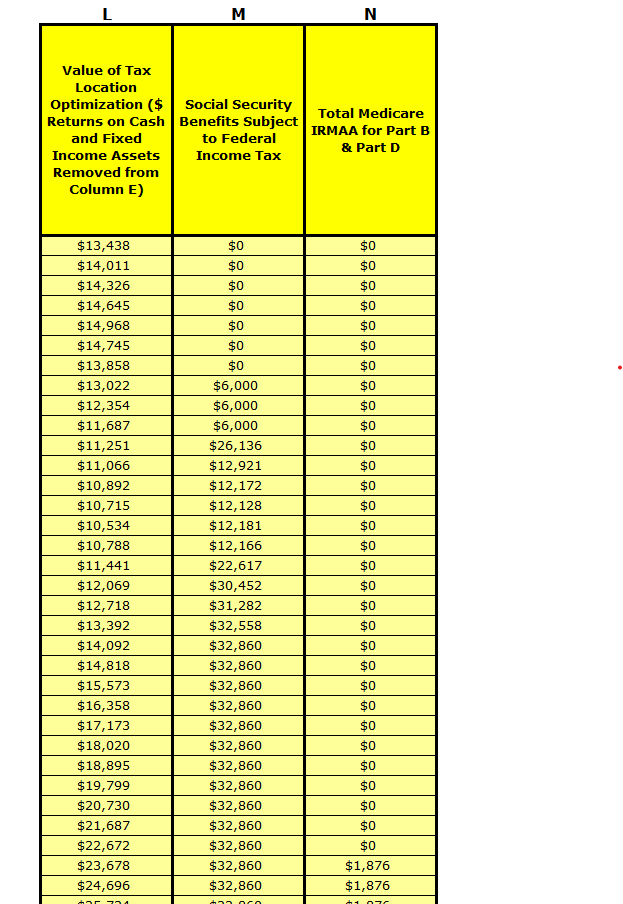

The graphic below shows the last three columns of VeriPlan’s year-by-year Roth conversion calculator planner. Given the example we have been using:

- the top top line is age 60

- the first $6,000 line of column M is when the spouse starts Social Security Payments at age 67

- the first year of any IRMAA surcharge in column N is age 91, if this Roth conversion plan were to be implemented.

- Note that the VeriPlan comparison tool indicates that without doing any Roth conversions, IRMAA would instead start at age 77 and keep rising over time. Without these Roth conversions, the Comparison Tool indicates that they would pay an additional $75,466 in IRMAA subsidy reductions between age 77 and 100, if they were so lucky to live that long. VeriPlan automatically includes these IRMAA savings in its projection models, so they are simply another component of the Roth conversion calculator payback — in addition to income tax savings — that all contribute to the breakeven age calculation.

The three sections that follow this graphic of Columns L, M, and N will explain each of them.

Column L: Do you plan to optimize your portfolio for asset tax location?

This VeriPlan year-by-year Roth conversion calculator tool, also looks at the current make-up of your cash, bond, and stock investment portfolio across your taxable account, traditional retirement account and Roth retirement account holdings. VeriPlan will automatically provide a summary percentage of your portfolio that could be optimized for asset tax location. Then, VeriPlan also provides the user with a choice as to whether they will or will not optimize their portfolio for asset tax location.

If the user indicates that they do NOT plan to tax location optimize the portfolio, then VeriPlan will automatically project the additional taxable cash and bond interest the user would earn in future years on cash and bonds held in taxable accounts. Particularly if the user’s taxable bond holdings are substantial and could otherwise be held in traditional retirement accounts, this decision will increase future taxable income and reduce future year-by-year opportunities to do low income tax and/or no income tax Roth conversions.

This couple indicated that they WOULD optimize their current portfolio for asset tax location. They chose to do so, because VeriPlan calculated that 34.78% of their current total financial asset portfolio that is now held as cash and bonds in taxable accounts could instead be held in their traditional retirement accounts.

Doing so will reduce the amount of taxable cash and bond earnings that would be taxed as ordinary income. By reducing their current taxable ordinary income each projections year, the will correspondingly increase the amount of traditional assets that could be converted to Roth assets in any particular year. Column L in the table above provide a projection of the year-by-year reduction in taxable income resulting from optimizing for tax location, which for this couple is substantial. If they chose NOT to asset tax location optimize their portfolio, then Column L would be all zeros.

Overview of “Tax Location” optimization related to the VeriPlan Roth conversion calculator

Investment asset classes differ substantially in how they are taxed. When held for over one year in taxable accounts (i.e. not traditional retirement accounts), equities (stocks) are taxed at federal long-term capital gains tax rates that are currently substantially lower than federal ordinary income tax rates. Qualified dividends are also taxed at long-term capital gains tax rates, and equity market appreciation is only taxed when there is a sales event. When equities are held in traditional retirement accounts, they lose these tax advantages.

In contrast, bonds and cash have recurring interest earning that are always taxed federally at higher ordinary income tax rates, when held in taxable (non-retirement) accounts. Bonds rarely generate long-term capital gains, and cash never does. When bonds and cash are held long-term in traditional retirement accounts, income taxes are avoided until Required Minimum Distributions (RMDs) begin. Furthermore, since historically bonds and cash have grow more slowly than equities, holding your investment bonds and cash in traditional retirement accounts will also tend to reduce lifetime RMDs.

Changing your portfolio to optimize for asset tax location would be done through offsetting buy and sell transactions within accounts — NOT through taxable distributions. For example, you would sell “X dollars” of bonds in taxable accounts and use the cash proceeds to purchase equities in the same taxable accounts. Then, you would sell “X dollars” of equities in your traditional retirement accounts and use the cash proceeds to buy bonds within the same traditional retirement accounts. Taxation on these transactions should be zero or minimal given that bonds usually do not have substantial capital gains in taxable accounts. (When interest rates have fallen significantly while you have held bonds in taxable accounts would create the situation when you might have some capital gains on bonds in taxable accounts.)

For more information about asset allocation and asset tax optimization, read the article titled “Lifelong tax savings from investment portfolio asset tax location,” which can be found on VeriPlan’s red-tabbed Optimizations worksheet.

Column M: Your federal income taxes related to Social Security retirement benefits may not increase smoothly

While the federal income tax system is a graduated income tax system wherein tax rates increase with higher income, there is some “non-linearity” caused by certain other tax rules.

When you are receiving Social Security retirement benefits, other taxable family income can increase the proportion of your Social Security that is subject to income taxation. The Social Security section of the yellow-tabbed Taxes worksheet summarizes these tax rules. Taxable Roth conversion amounts can simultaneously increase the amount of your Social Security retirement income that is subject to income taxation.

The VeriPlan Roth conversion calculator will calculate this automatically in your projections. However, you may not be aware that your planned Roth conversion amount in any given year would also increase taxes on your Social Security retirement income, as well. So that you can understand when this is happening note the amount of Social Security subject to income taxes in the same year in column N in the table above, before you make a Roth conversion entry into column D for that year. Then, after you have made an entry into column D, recheck column N to see if the amount Social Security retirement benefits subject to taxation has increased in that year. At lower income levels this may change. At higher income levels it will not change, because the maximum of 85% of Social Security benefits subject to federal income taxation would already have been reached.

Column N: Roth conversions can lower Medicare IRMAA premium subsidy reductions

The VeriPlan Roth conversion calculator also automatically projects any “Income-Related Monthly Adjustment Amounts” (IRMAA) subsidy reductions related to Medicare Part B and Part D monthly premiums. For VeriPlan to project IRMAA premiums for you, you must first turn on VeriPlan’s Medicare and retirement healthcare cost features on the Medicare worksheet. Then, either use the Medicare cost defaults provided or enter your own Medicare cost assumptions.

IRMAA is a reduction in Medicare’s subsidy of insurance premiums related to higher family income. For more information see the IRMAA section of the yellow-tabbed Retirement worksheet. While not formally a direct income tax, IRMAA functions like an increased income tax for higher income senior citizens.

In the table above, column N shows whether projected income after age 65 would be high enough for you to be subject to IRMAA surcharges and at what level. Before you enter any Roth conversion amounts, check Column N to see whether you will be subject to IRMAA in the future and at what age IRMAA will start. Note that once IRMAA starts, these Medicare insurance premium subsidy reductions tend to continue and to increase. This is due to the fact that the RMD formula can produce higher and higher taxable income over time, and this will usually continue through age 100.

You can also use the “Medicare Parts B & D IRMAA” column in the expenses section of the VeriPlan Comparison Tool to understand the aggregate impact of any Roth conversion plan on IRMAA. Since the Comparison Tools shows differences between two projection plans, you can see how many years earlier IRMAA would start and how much more it would cost, if you did not implement that particular Roth conversion plan.

VeriPlan automatically includes these IRMAA savings in its projection models, so they are simply another component of the Roth conversion payback — in addition to the income tax savings — which combined all contribute to the breakeven age calculation. Since IRMA savings are already in the projection model, they do not further reduce the breakeven age, because they have already been taken into account in the projection calculations.

As mentioned with the Columns L, M, and N chart above, the couple in our example is projected to save $75,466 in IRMAA subsidy reductions between age 77 and 100. Since their breakeven age was 91, about $41k of that total would contribute to the breakeven age of 91 and the remaining $34K would be realized between ages 92 to 100 as increased assets.

A note about Roth conversions and ACA tax subsidies before Medicare:

For those who expect to have the good fortune to accumulate sufficient assets to retire early, it might seem that you may have additional years where Roth conversions could be feasible. However, for those who retire prior to age 65 and Medicare, the substantial cost of medical insurance should be a consideration. For those with low taxable income before age 65, the medical insurance premium tax credit subsidies available under the Affordable Care Act (ACA) can be quite substantial. Because Roth conversions are counted as income under the ACA’s modified adjusted gross income calculations, this needs to be taken into account.

For persons in this situation, it may be appropriate to avoid Roth conversions in years prior to Medicare at age 65. ACA premium subsidies can be a substantial tax credit. ACA calculations are complex and can vary by family size, income level, and state of residence. Low income in any particular year does not necessarily mean that a person is poor. It just means their taxable income is low for the particular year. For more on the topic, see the red-tabbed Optimizations worksheet for the article titled: “Early retirement health care expenses and ACA tax subsidies before Medicare”

Because of ACA tax credits can exceed $20,000 for a family, their value tends to dominate the trade-off between ACA tax credits and the value of doing additional Roth conversions prior to age 65 and Medicare. After age 65 and Medicare tends to be the sweet spot for doing Roth conversions for most people.

Doing Roth conversions in any low income tax rate year prior to retirement

You are more likely to benefit from Roth conversions in years when your taxable income is expected to be low and thus your income tax rates are expected to be correspondingly low. Such low income years could also occur prior to retirement.

Years that present Roth conversion opportunities are un-paid sabbatical years or unemployment years, when you have other assets to pay the bills. Unexpected career disruptions can happen to anyone. (Can you say “pandemic?” Mr. Rogers knew you could.) While these situations can be miserable emotionally, Roth conversions are a silver lining.

You expect that you will get back on your career track, but sometimes it takes many months or longer if the economy is bad. While you live on your savings, you might have a year or two of partial earnings that put you into much lower income tax brackets. Later, you will be pleased that you did not miss the opportunity to do some very low tax or no tax Roth conversions, while other things were unavoidably awful.

You might also have substantial tax deductions that increase the amount that you could convert effectively at a 0% tax rate. Remember that the standard federal income tax deduction is part of the taxable income calculation. If you have no reportable income, but still have deductions, there is no income tax on Roth conversions up to your maximum allowable deduction.

For Roth conversions to be feasible in any year, you also need to have accumulated enough financial assets in taxable accounts with enough tax basis for you to pay your ongoing living expenses, debts, and taxes. Otherwise, you would need to withdraw funds from traditional retirement accounts to pay the bills, which would drive up your taxable income and narrow your Roth conversion opportunity — and could even involve the 10% early withdrawal penalty before age 59 and 1/2, if you have to withdraw retirement assets without an exception.

Prepare a “pro forma” tax return to determine the optimal Roth conversion amount for the current year

The VeriPlan Roth IRA conversion calculator is designed to evaluate the financial utility and breakeven age of Roth contributions and conversions across a lifetime planning model. In addition, if Roth conversions might be financially attractive across your lifetime plan, the year-by-year Roth conversion tool above helps you to plan ahead to identify the years when it is more likely for you to be able to do Roth conversions. If you determine with VeriPlan that Roth conversions in certain years could be a desirable strategy for you, the preparation of a “pro forma” tax return near the end of each of those conversion years will help you to further optimize your tax planning.

When you actually reach a planned ages for a Roth conversion and decide to implement that Roth conversion in the current year, I suggest that you also prepare a pro forma tax return for the federal tax return you will file in the spring time. Since Roth conversions can no longer be re-characterized (i.e. be reversed), Roth IRA conversions will typically be done in the last month or two of the year so that you understand financial market performance during that tax year.

To determine the specific conversion dollar amount in any particular year, I suggest preparing an anticipatory pro forma income tax return near the end of the calendar year, because certain tax code complexities can affect tax rates on Roth conversions.

For example, as discussed above, as other ordinary income increases, 50% up to 85% of Social Security becomes subject to taxes. This creates non-linearity in tax rates, as taxable ordinary income rises. Also, if you have long-term capital gains to report, increasing income can increase LTCG taxes. For those who retire early before Medicare, another factor that can affect the tax calculation is Affordable Care Act premium tax subsidies. As modified adjusted gross income increases, ACA subsidies decline, and Roth conversions are counted as part of ACA modified adjusted gross income calculations.

Personally, for many years, I have used TurboTax for filing my taxes in the spring. (Other tax preparation software could work, as well.) Then, later in the year — usually in November I use TurboTax to develop a pro forma income tax return estimate for the coming year by inputting estimates for the tax return that I would file in the spring of the next year. With this pro forma estimated tax return, I then add in various Roth conversion amounts and calculate the average tax rates on these Roth conversion amounts.

I decide on the specific Roth current year conversion amount by noting when tax rates on Roth conversion amounts jump up noticeably. I get this done by Thanksgiving to leave time to implement the actual conversion of traditional retirement account assets to Roth assets in early December. This leaves time to confirm that the financial custodian actually did the conversion for me and to correct any problems.

You should note that I am now a somewhat old fart (past 70). I have been semi-retired since my early 50s — although I have not had the good sense to stop playing around with developing VeriPlan and doing financial plans for clients. This means that I have had many years to do relatively small Roth conversions that have added up over those years. I was in my 50s, just after the turn of the century, when I began to understand the advantages and pitfalls of Roth contributions and conversions and their highest value in certain years..

When I worked in the computer industry in Silicon Valley in the 1980s and 1990s (my 30s and 40s), Roth conversions were not yet “a thing.” Even if Roth accounts were a thing then, my taxable income and income tax rates while working at HP and Sun Microsystems were sufficiently high that I never would have been able to recoup the higher up-front tax payments, even if I lived to 100. By doing numerous small Roth conversions in my semi-retirement years, the numbers have been a lot better. That will be true for most people. When your earnings are high, take advantage of the income tax savings from traditional retirement contributions. Then, convert some of those traditional assets in the early years of retirement to optimize your lifetime financial plan.

I have produced these informational videos, which are available on YouTube: “How to Optimize Lifetime Roth Contributions and Roth IRA Conversion Taxes”

Video #1 — Overviews the best lifetime Roth contribution and conversion strategies for most people

https://www.youtube.com/watch/PaYC7MnX_9U

https://www.youtube.com/watch/Ij890zUr1OA