Do-It-Yourself Financial Planning – Earned income drives the personal finances of most people

The ability to project your various income sources automatically over your lifetime is one of the first steps in creating a useful do-it-yourself personal financial plan. Whether from wages and salary or from self-employment, personal earned income drives the lifetime finances of most American families. Obviously, more income is better. In addition, dependability of income influences the income risk to a family’s lifetime plan.

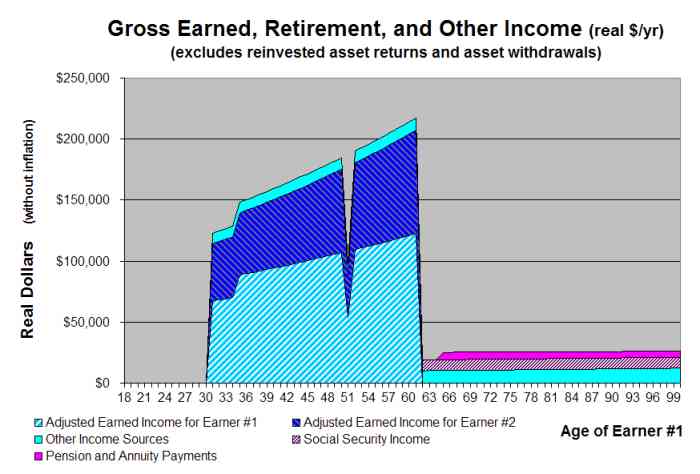

VeriPlan’s “INCOME” graphic, which is entitled: “Gross Earned, Retirement, and Other Income,” projects your various income sources in real or constant purchasing power dollars over your lifetime. This graphic projects the income associated with earned income sources, including:

* your earned employment and actively-managed business income

* your pension and annuity income

* your Social Security income, and

* you “Other Income.”

These income sources summarize your earned income sources and that non-asset related retirement income that is generally associated with your earned income. No income from assets nor any capital appreciation is represented on this graphic. Asset income is assumed to be taxed and reinvested. Assets are withdrawn only in years when you are projected to have a cash expense to earned income shortfall. VeriPlan automatically provides many other graphics and data tables that provide lifetime projection information related to your various assets.

An example of VeriPlan’s INCOME graphic for a professional couple with children

Below is an example of VeriPlan’s INCOME graphic, which is automatically generated for every projection that you make in VeriPlan. This particular graphic comes from VeriPlan’s “Sue and Sam Saver” tutorial. This graphic shows Sue and Sam’s projected income, which is directly or indirectly associated with earned income sources and excludes income from their asset portfolio.

Demonstrating a comprehensive projection for a professional couple with children, the VeriPlan tutorial can help you to understand what VeriPlan can do. Use this link to download a free copy of the VeriPlan tutorial file:

Your earned income will also reflect any income adjustments that you make. In this case, Sue and Sam are testing two adjustments to Sam’s employment income. First, they project that he will be promoted in four years and receive a substantial real dollar raise. Second, they project that Sam will be unemployed for six months when he is 50 years old. The adjustments are just illustrations of your ability to adjust your income projection assumptions in VeriPlan in any year or in every year.

VeriPlan Is Simply The

Best Financial Planning Software

You Can Buy!

Only $57 for a license for ALL your household PCs

… with Free Shipping of the CD within the USA

Full 30-Day, 100% Money Back Guarantee — No Questions Asked

No Support Contract Required

No Need To Buy Upgrades, Since All Parameters Are User-Changeable

VeriPlan is a Great Product, a Great Deal,

and a Great Help with Your Personal Financial Planning.

Thank You Very Much for Your Order!

Note: We mail your VeriPlan CD on the next business day after PayPal has notified us of your order. When your order ships, we will send a shipment notification email to you using the email address supplied by PayPal. VeriPlan is shipped via the USPS, and deliveries typically take 3 to 10 days to arrive.

.