Two examples of the Tax Assets graphic in VeriPlan

TAX ASSETS: Taxable and Tax-Advantaged Financial Assets (real $/yr)

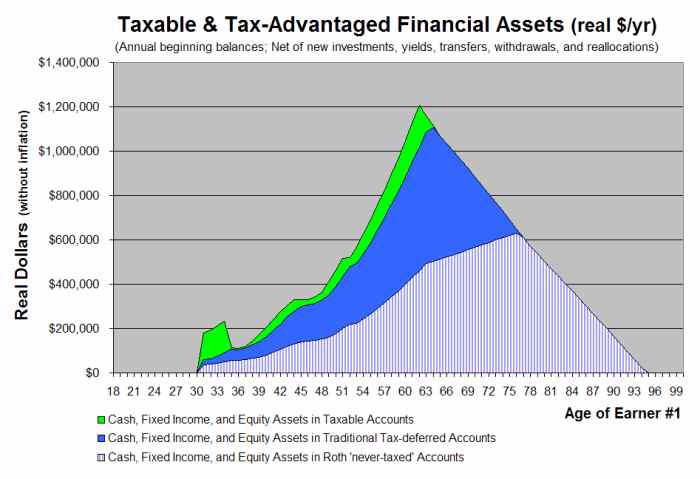

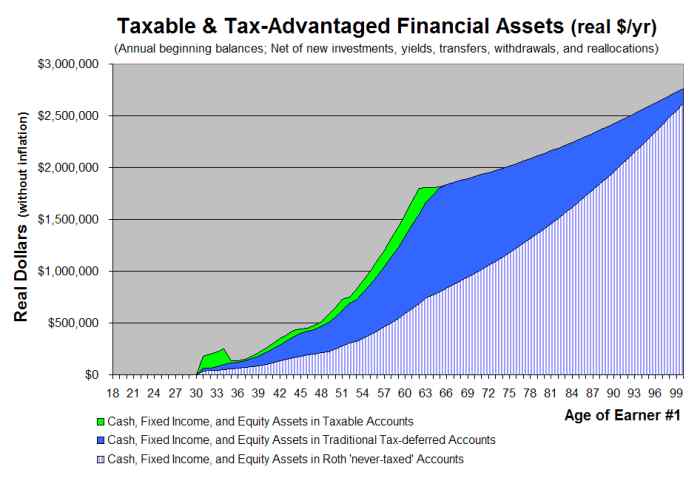

Below are two examples of the blue-tabbed TAX ASSETS graphic, which come from VeriPlan’s “Sue and Sam Saver” tutorial. This graphic separates their cash, bond, and stock assets by account taxability throughout their lifetime projections. Assets are separated into A) taxable accounts, B) traditional “tax-deferred” accounts, and C) Roth accounts, which are not taxed after contributions are made.

This first tutorial graphic shows Sue and Sam’s projection which uses industry average investment costs. VeriPlan automatically extracted the investment cost information that Sue and Sam provided about their portfolio on VeriPlan’s yellow-tabbed assets worksheets. Sue and Sam pay investment costs that are about average for full service retail brokerage customers.

Choosing to begin their retirement at age 62, they begin to withdraw assets to meet retirement living expenses. First, they liquidate their taxable asset accounts and then their traditional tax deferred retirement accounts due to both mandatory distribution rules and to the need to cover their retirement expenses. Next, they liquidate their Roth retirement accounts, which are fully liquidated in their mid-90s. To meet their living expenses after that, they would need to liquidate some of their real estate, property, or other assets.

This second tutorial graphic shows Sue and Sam’s revised projection with lower investment costs that they consider to be more reasonable. These lower costs are based on the reasonable investment cost assumptions that they entered into Section 4 of VeriPlan’s orange-tabbed “6-COST-EFFECTIVENESS TOOL” worksheet.

With lower investment costs, Sue and Sam’s cash, bond, and stock financial assets build up much more prior to retirement, and these assets continue to grow in retirement even though Sue and Sam are withdrawing assets to meet expenses. First, VeriPlan automatically liquidates their taxable asset account assets to meet retirement expenses.

Then, VeriPlan automatically draws down their traditional tax-deferred retirement account assets to meet the greater of either their retirement expenses or the IRS’s mandatory withdrawal rules for traditional tax-deferred accounts. However, because of the improved cost efficiency of their investment portfolio, their traditional tax-deferred retirement account assets are sufficiently large that these accounts can continue to grow despite their withdrawals. Furthermore, Sue and Sam’s Roth retirement account assets grow untouched and untaxed throughout retirement and exceed $2.5 million in current, real dollar purchasing power at age 100. These Roth assets would be available for inheritance by their children or for charitable donations.

VeriPlan Is Simply The

Best Financial Planning Software

You Can Buy!

Only $57 for a license for ALL your household PCs

… with Free Shipping of the CD within the USA

Full 30-Day, 100% Money Back Guarantee — No Questions Asked

No Support Contract Required

No Need To Buy Upgrades, Since All Parameters Are User-Changeable

VeriPlan is a Great Product, a Great Deal,

and a Great Help with Your Personal Financial Planning.

Thank You Very Much for Your Order!

Note: We mail your VeriPlan CD on the next business day after PayPal has notified us of your order. When your order ships, we will send a shipment notification email to you using the email address supplied by PayPal. VeriPlan is shipped via the USPS, and deliveries typically take 3 to 10 days to arrive.

.